Kalshi’s valuation overtook DraftKings on Friday morning, after shares in the sportsbook giant plunged to an almost three-year low following its annual results.

Shares in the sports betting operator dropped Friday after the business published its full-year results, alongside guidance for 2026. While the results were better than expected, the revenue results and earnings guidance were lower.

Within minutes of markets opening at 9:30 a.m. ET Friday, DraftKings shares were down 15.0% to $21.28. That suggests a market capitalization of $10.7 billion, around $2 billion less than its market cap at the close of trading Thursday. Shares picked up a little by 9:50 a.m. but were still down more than 12% at $22.01, meaning the company was still valued by the market at less than $11 billion.

Last year, Kalshi raised $1 billion at an $11 billion valuation. Its valuation today is likely at least as high, with private market data provider PM Insights estimating the business was worth $11.46 billion in early February, based on secondary sales.

DraftKings shares have tumbled since August

DraftKings’ shares have slid dramatically in the past six months, coinciding with prediction markets’ jump in activity during football season. While the rise of prediction markets appeared to have played a large part in the decline, bettor-friendly sports results during the NFL regular season likely played a part too. The shares peaked at $48.23 in late August, just before the start of the college football season, but are now worth less than half of that.

That decrease since late August equates to a loss of roughly $14 billion from the company’s market capitalization, with shares down more than 70% from their all-time high of $71.98 on March 19, 2021.

The fall brings DraftKings shares to their lowest in almost three years.

The DraftKings results spooked investors enough to cause FanDuel owner Flutter Entertainment’s shares to plunge as well. Flutter shares fell 5% Friday to $134.30. They are down 56% since early August and at their lowest since 2022.

Though the 2025 results themselves largely beat Wall Street’s expectations, the market reacted negatively to the company’s future prospects. A major reason for the drop was DraftKings’ lower-than-expected projections for 2026.

While the operator’s anticipated revenue figure between $6.5 billion and $6.9 billion would still be higher than its 2025 revenue, it would suggest a notable slowdown in growth.

The business is projecting adjusted earnings before interest, tax, depreciation, and amortization (EBITDA) for the year to be between $700 million and $900 million, again up on 2025, but well behind Wall Street’s expectations. That guidance was also lower than the 2025 guidance that it made a year ago, which was between $900 million and $1 billion. DraftKings failed to hit that figure, with full-year adjusted EBITDA in 2025 coming to $620.0 million.

That 2026 adjusted EBITDA figure likely includes a significant amount of expenditures on marketing DraftKings’ prediction market product, though the company did not break out the exact amount. In a letter to shareholders, CEO Jason Robins wrote that the business is going to spend big on acquiring customers for its prediction market and that the vertical will generate “hundreds of millions in annual revenue” in the years ahead.

Robins says guidance was deliberately conservative

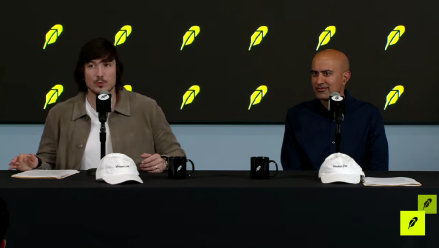

On the company’s earnings call Friday morning, Robins said the company had been deliberately conservative on its 2026 guidance after its initial 2025 guidance had been too high.

“I thought we had a good year last year, so it was very frustrating that we missed our guide,” he said. “So I think we really went back the other way and said we’re going to be conservative.

“My team came and gave me a number and said, ‘We can hit this,’ and I said, ‘Make it lower.’ They came back with another number and said, ‘We’re sure we can hit this.’ I said, ‘I don’t care — make it lower again.’”

On a note to clients, Citizens analyst Jordan Bender wrote that there were reasons to believe the full-year guidance was conservative, but there were also downside risks from possible tax rises that the guidance did not price in.

“On one hand, we view the guidance as conservative, with costs baking in new investment opportunities like the ESPN partnership and DraftKings Predict, but no upside for revenue,” he said. “The announcement that DraftKings will start market-making for prediction markets is an opportunity that we believe is not fully understood and could prove to be an upside catalyst for the stock. Market-making fees are lucrative and add a second source of revenue for the company that was absent this time last year.

“That said, the guidance not including incremental tax increases beyond what we know today could give investors pause in thinking that EBITDA could be conservative, since the last several years have proved states are willing to increase taxes.”

DraftKings also reported a profitable 2025 in terms of net income, the “standard” measure of profitability. It was the company’s first profitable year since it went public. DraftKings CFO Alan Ellingson said he was “particularly proud” of achieving positive net income.