DraftKings has acquired CFTC-registered prediction market Railbird, following months of speculation about the sports betting giant’s plans to get into the event contracts space.

DraftKings announced the deal, which it said would “advance further growth in prediction markets,” via press release as markets closed Tuesday.

Railbird was registered by the Commodity Futures Trading Commission (CFTC) as a designated contract market (DCM) in July, allowing it to create its own event contract markets and partner with other companies that wish to offer its contracts.

Through the deal, DraftKings will now be able to do the same.

“We are excited about the additional opportunity that prediction markets could represent for our business,” said Jason Robins, CEO and co-founder of DraftKings. “We believe that Railbird’s team and platform — combined with DraftKings’ scale, trusted brand, and proven expertise in mobile-first products — positions us to win in this incremental space.”

DraftKings Predictions to launch soon

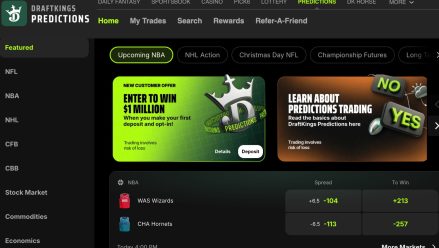

Alongside the deal, DraftKings will launch DraftKings Predictions, a new mobile app that “will allow customers to trade regulated event contracts on real-world outcomes across finance, culture, and entertainment.”

Although DraftKings will own a DCM, it noted that “the product will have the flexibility to connect to multiple exchanges.” That means that DraftKings Predictions may also feature contracts from a different CFTC-registered prediction market, such as Kalshi.

Terms of the deal, such as the purchase price, were not disclosed. DraftKings has a pending application with the National Futures Association (NFA), which is the first step to becoming a futures commission merchant (FCM), which can partner with other DCMs.

DraftKings says that DraftKings Predictions will “debut as a mobile application in the coming months.”

Will DraftKings Predictions include sports?

Absent from the list of topics covered by DraftKings Predictions was sports. However, the press release adds that “its offering may expand into additional categories over time, deepening customer engagement and extending DraftKings’ addressable audience,” which appears to be a reference to the idea that sports may eventually be added.

State gaming regulators across the country have said they consider sports event contracts to be an illegal form of gambling. In states including Ohio, Arizona, and Michigan, regulators have warned sportsbook licensees that getting involved with sports event contracts could be cause for action including license revocation.

Ohio’s Casino Control Commission noted that even if a licensee does not offer sports event contracts in Ohio, partnering with a company that does could still be grounds for it to take action.

DraftKings finally reveals prediction market plan

The deal finally answers the question of how DraftKings would respond to the rise of prediction markets.

The business first filed for NFA status in 2024, before withdrawing its application in March of this year, only to reapply in June.

Rumors of DraftKings acquiring Railbird first emerged back in July, soon after the exchange gained CFTC approval.

In a second-quarter earnings call in August, Robins said the business was in “monitor mode,” watching what other companies are doing and then deciding on next moves.

Earlier this month, Robins said “I just don’t see a world” where customers choose prediction markets over sportsbooks in states where both are legal, but added that the markets may have more value in states where sportsbooks are not allowed to operate, like California or Texas.

In August, arch-rival FanDuel announced its own plan to get involved in the space, via a partnership with CME, in which the two companies would form a joint venture that would apply for FCM status. That joint venture plans to offer markets that resolve in just one hour, based on commodities like gold or indices like the S&P 500.

Daily fantasy giant Underdog has already launched its own prediction market product through a partnership with Crypto.com, in which Underdog is a “technical service provider,” which means it does not have any status with the CFTC. Underdog offers event contracts on sports through its prediction market product, which is available in 16 states, mostly where sports betting has not been legalized.

Little known about Railbird

Despite having CFTC approval, Railbird has not yet launched its prediction market product in the U.S., so little is known about the business so far.

The business first applied for DCM status in 2022. That extensive wait for CFTC approval is common, and helps explain why DraftKings opted to acquire an already-registered exchange rather than apply for DCM status itself.

The business was founded in 2021 by Edward Tian and Miles Saffrah, who both previously worked at hedge fund Point72. It secured initial funding through the prestigious Y Combinator accelerator program, as part of its Winter 2022 batch of startups.

A rulebook filed with the CFTC notes that Railbird will use QC Clearing — a business now owned by Polymarket — for clearinghouse services, which include the actual buying and selling of the contracts behind every trade, and the paperwork and movement of money associated with those purchases.

“This is a transformational moment for our company, and we are thrilled to be a part of the future of DraftKings,” said Miles Saffran, CEO and co-founder of Railbird. “DraftKings’ scale and leadership in the industry creates meaningful opportunities for our team and platform.”

DraftKings shares jump — but still down on year

DraftKings shares rose in after-hours trading on the news of the deal, by 7.1% to $36. That adds $1.2 billion to the company’s market cap, making the business worth around $18 billion.

However, that would still leave the shares down more than 25% — or the company worth $6 billion less — compared to late August, before the start of football season led to a surge in popularity for leading prediction market Kalshi.