FanDuel didn’t attempt to reinvent either itself or the prediction market app when it launched FanDuel Predicts last year. That was sensible, given its hefty national sports betting market share and its parent company’s roots with the Betfair exchange.

Instead, FanDuel Predicts gives sports bettors and prediction market newcomers alike something comfortable, while attempting to teach them something new and, ultimately, entice them to patronize everything the company offers, James Cooper, senior vice president, Flywheel and New Ventures at FanDuel told InGame.

“The vision was: ‘How do we create something that leverages all of our knowledge and experience of knowing what a sports bettor wants from running sportsbooks? How do we bring the experience of Betfair, what an exchange customer wants, and how do we think about what the future might look like? Also looking at Kalshi and Polymarket and others and what they’ve done as they’ve entered the space as well?” Cooper said. “If we had to start the sportsbook again, what would we do differently? If we had to start the exchange business again, what would we do differently? So it’s really trying to marry all the experience we have from different places to get to something that we think is going to be compelling for customers.”

The app was built in-house within calendar year 2025. That’s pleasantly brisk, Cooper said, but not unheard of, considering the in-house expertise at FanDuel and parent company Flutter, which owns United Kingdom-based Betfair exchange.

Months of building didn’t yield anything visually revolutionary, and that was part of the idea. The easily recognizable FanDuel blue, fonts, and design of the app allow users, particularly prediction market newcomers, to quickly figure out what FanDuel Predicts is all about.

Using FanDuel Predicts

InGame ran the app through its paces in the week leading up to Super Bowl LX, trading in and out of basketball positions and dabbling in the first use of parlays — combos in prediction market parlance — between sacks of New England quarterback Drake Maye. Registration, funding, and play were not noteworthy, because they were glitch-free. That quickly allowed the fun, or the education, to begin.

Cooper said activity during the Super Bowl was brisk, but he was unable to elaborate ahead of a Q4 earnings report on Feb. 26.

“[Users] like how it’s similar to other things that they’ve seen. But it’s definitely different, and there’s an ease of use that we’re kind of shooting for on this versus, I think, sportsbooks [which] can be quite intimidating when we first start,” Cooper said. “We focus a lot on the education part, because we want customers to really understand what this is, how it’s different from other products in the market.”

Though FanDuel Predicts isn’t the only prediction market app to brandish a multiplier interface as a way of pricing “Yes/No” markets, its display as a default makes the app unique. Fanatics Markets utilizes a traditional cents-pricing display for $1 markets, while DraftKings deploys moneylines like sportsbooks. All of those options are available on FanDuel Predicts, with percentages as a fourth choice, and are easily switchable on the home screen.

“We did some research to see which of the four of these resonates best and the multiplier was one that was very simple for customers to understand. If I put $10 on and this is 2.05x, I get $20.50 back. The math is easy,” Cooper explained. “For a casual customer, that’s much easier to do than trying to work out what -115 means.”

Cooper believes experienced customers will switch to familiar displays. Sports bettors, he said, would be expected to favor odds.

The app will eventually add price charts, Cooper said, for tracking market movement.

What’s next for FanDuel Predicts?

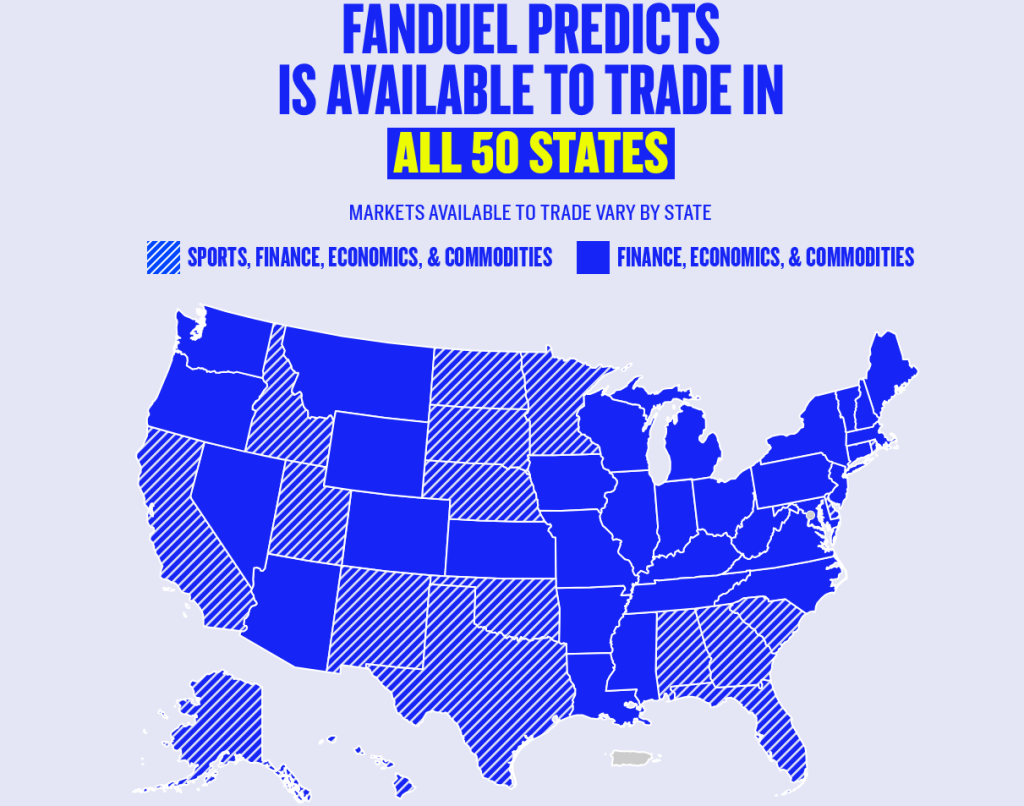

Launched in five states on Dec. 22 and available in all 50 by mid-January, FanDuel Predicts came to market through a partnership with derivatives platform CME Group, a designated contract market (DCM) certified by the Commodity Futures Trading Commission (CFTC). It offers sports event and financial market contracts, but not the salacious stuff found on the likes of Kalshi — government overthrows, etc. As of now, it has only dabbled in pop-culture-awards markets like the Emmys.

More will follow, Cooper said, noting that FanDuel Predicts must build its own markets in those realms, because CME Group does not. There will also be more combos around everyday sports events, he said. Cooper expects them to be popular.

“[Flutter was] the first to bring same-game parlays to the industry on the sports betting side, and I think we do same-game parlay better than anyone else from a sportsbook perspective,” he said. “We have the same aspirations on combos in prediction markets. It’s a place where we would expect to lead in the future.”

Who is using FanDuel Predicts?

It’s still too early, Cooper said, to understand who a FanDuel Predicts customer is right now. Are they newcomers in states without sports betting hoping to engage with something familiar or current bettors trying something new? That was partly why, Cooper said, the version launched in New York and New Jersey incorporated financial markets, but not sports.

The goal, said Cooper, who oversees FanDuel’s prediction market, horse racing, and daily fantasy sports operations, is for them to patronize multiple apps.

Part of the customer-education process, Cooper said, will entail buying and selling stakes in games in real-time. FanDuel, like other sportsbooks, utilize cash-out features, but trading a result like a stock will be new to many.

“We think that will be a differentiator in this space,” Cooper said. “People will trade in and out a lot more than typically how they’ve done on sports betting in the past, just because it is much more intuitive to know what your position is and how you would increase or decrease that stake, rather than it being the binary ‘I’m in’ or ‘I’m out,’ which is the experience on sportsbooks.”