The Illinois Gaming Board reported $5.2 million in tax receipts from its wager surcharge for July on Thursday, the first month it had been in effect.

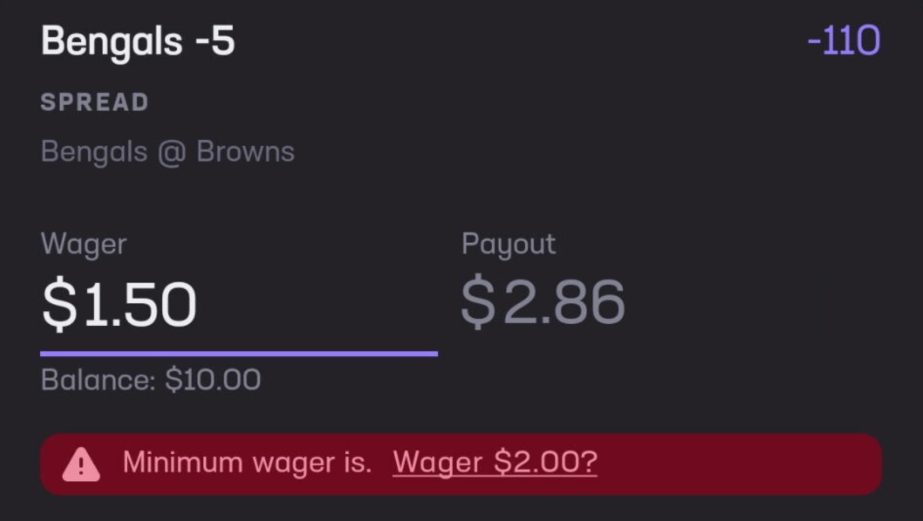

The surcharge, the first of its kind in any state with commercial sports betting, charges a mobile licensee 25 cents per wager for its first 20 million wagers in a fiscal year and 50 cents thereafter. All of Illinois’ 10 digital sportsbooks have either instituted or plan to institute a countermeasure to the surcharge ranging from lifting bet minimums, enacting a surcharge of their own, or utilizing a passthrough on the wager to neutralize the surcharge.

The surcharge was a late addition to the Fiscal Year 2026 budget passed in May and signed into law by Gov. JB Pritzker. It was the second straight year the sports betting industry was targeted by the state for more tax revenue. The state’s budget for FY 2025 moved operators from a flat 15% tax on adjusted gross revenue to a progressive one, with tax rates ranging from 20% to 40% for licensees based on revenue thresholds.

Overall, sportsbooks reported $89.7 million in adjusted gross revenue (AGR) for July, up 23% from last year, as they attained a 10.2% hold on $862.5 million handle. With July marking the start of the fiscal year in Illinois, all operators returned to the floor 20% tax rate as receipts from AGR totaled $17.6 million. The $23.2 million in total state tax revenue from sports betting was up nearly $9 million from last year.

FanDuel, DraftKings bear the brunt of costs

| Mobile Sportsbook | Wagers | Wager Surcharge |

| DraftKings | 8,312,137 | $2,078,034.25 |

| FanDuel | 7,518,289 | $1,879,572.25 |

| Fanatics | 1,229,106 | $307,276.50 |

| bet365 | 995,989 | $248,997.25 |

| BetMGM | 817,418 | $204,354.50 |

| BetRivers | 556,535 | $139,133.75 |

| Caesars | 483,965 | $120,991.25 |

| ESPN BET | 466,588 | $116,647.00 |

| Hard Rock Bet | 398,267 | $99,566.75 |

| Circa Sports | 26,953 | $6,738.25 |

| TOTALS | 20,805,247 | $5,201,311.75 |

Even in the slower months of the sports betting schedule, the wager surcharge already projects to have an outsized effect on heavyweights DraftKings and FanDuel. The pair accounted for a combined 76.1% of the total amount raised by the surcharge. It also shows why both targeted Sept. 1 as the date to enact their respective half-dollar surcharges since both project to cross 20 million in accepted wagers at some point during September.

The second tier of mobile operators based on volume — Fanatics, bet365, and BetMGM — have the potential to reach 20 million wagers over the course of the fiscal year, which runs through June 30. Fanatics appears the most likely to hit the benchmark considering its current growth trajectory should result in increases to the average of 1.4 million wagers accepted from September through December of last year and 1.5 million spanning the first six months of 2025.

The strong performance by FanDuel and DraftKings brought another accelerated consequence: They moved into the 25% tax bracket after clearing the first revenue threshold of $30 million. DraftKings had a state-best $31.7 million in winnings, while FanDuel edged into the second tier by less than $19,000. FanDuel topped mobile operators with an 11.6% hold, and DraftKings notched a 10.5% win rate on a state-best $301.3 million in completed events handle.

Fanatics locking down third spot

With increased business comes increased revenue, and Fanatics has become a clear-cut third choice among Illinois bettors. It claimed $6.9 million in revenue for July, a 33.8% year-over-year increase, thanks to a 10.3% hold on $67 million handle. BetMGM was the other mobile book with a double-digit win rate, also at 10.3%, in reaping close to $5 million in winnings from $48.2 million worth of wagers.

BetMGM and BetRivers were separated by less than $35,000 in handle, but BetRivers’ hold of 9.1% led to $4.4 million in winnings and a gap of $596,300. England-based sportsbook bet365 continued its solid rookie season in Illinois, crafting a 9.3% hold to collect $3.2 million in revenue.

The back four was comprised of Caesars ($3 million), ESPN Bet ($1.8 million), Hard Rock Bet ($1.7 million), and Circa Sports ($265,400). The 10 mobile books combined for a 10.5% hold in July, grossing $87.9 million from $840 million handle.