A pair of integrity monitoring technology service providers announced on Monday a partnership aimed at shoring up the integrity and credibility of trading across the rapidly expanding prediction market industry in the U.S. and internationally.

The duo of the Las Vegas-based Integrity Compliance 360 (IC360) and Eventus, which has offices in Austin, Texas and the United Kingdom, “lets clients build a full-lifecycle integrity approach — pairing Validus’s real-time, 24/7 trade surveillance, alerting, and case management with IC360’s event-integrity and insider-risk capabilities,” said Eventus CEO Travis Schwab in a news release. “Together, we’re helping prediction market venues build trust with participants and regulators and establish the standards that will support responsible growth worldwide.”

Eventus’ main product is Validus, which is “built for at-scale multi-asset compliance” and contemplates social media activity around market events.

This comes at a time of parabolic growth in the prediction market sector as well as increasing scrutiny over the integrity of trading on the platforms handling the most trading activity, including Kalshi, Polymarket (not yet officially live in the U.S.), and Crypto.com.

In recent weeks, unusual betting activity and suspected insider trading have occurred on several occasions, most notably on Dec. 4 when a Polymarket trader apparently profited over $1 million betting on Google search results markets.

Questions of integrity abound

IC360 has a significant presence in the U.S. within the regulated sportsbook industry, serving most of the roster of major operators, including DraftKings, FanDuel, Hard Rock, Rush Street Interactive, BetMGM, and Caesars. Likewise, IC360 has forged partnerships with most of the major professional sports leagues, including the NFL, MLB, NBA, NHL, and MLS, plus UFC and the PGA Tour.

It was an alert from the IC360 system that triggered the investigation into Cleveland Guardians pitcher Luis Ortiz, which resulted in the indictment of Ortiz as well as teammate Emmanuel Clase, another pitcher who faces charges including wire fraud conspiracy.

Eventus’ experience is rooted in the exchange-based systems that undergird the prediction market industry.

“Eventus delivers institutional-grade post-trade market surveillance — the same capabilities trusted by global exchanges, designated contract markets (DCMs), broker-dealers, leading digital asset venues and other financial institutions — to help prediction markets scale with credibility and regulatory readiness,” says the joint release.

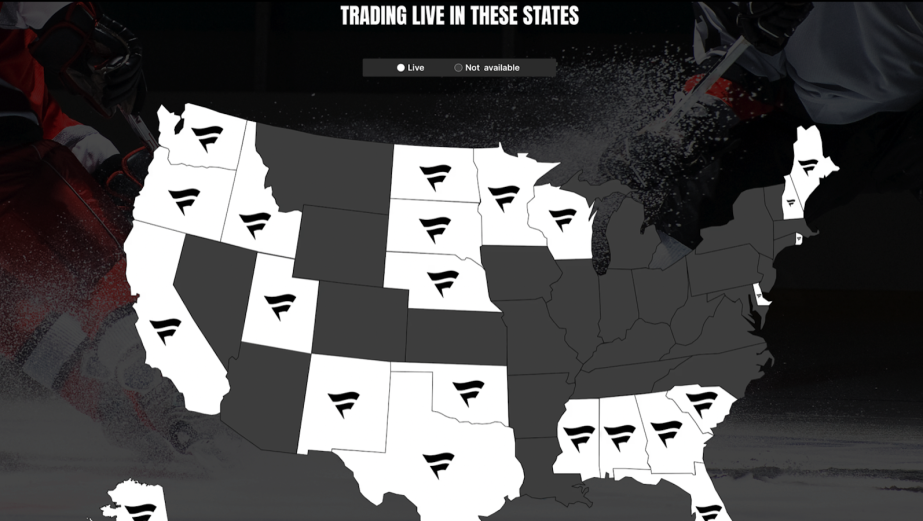

One platform, Kalshi, partnered with IC360 in March. At that time, Kalshi said it would utilize IC360’s ProhiBet service, which is an “encrypted list of individuals who are prohibited from engaging in prediction markets or sports betting.”

The adequacy of those measures are up for debate at a time when more and more dollars are flowing onto the platform, markets continue to expand, and potentially more individuals with insider info may seek ways to leverage that intelligence for their own benefit to the detriment of traders on the other side.

Ultimately, consumer confidence factors in, and when trust is lost, it is hard to gain back.

“For prediction market operators, Eventus tailors [its] infrastructure to the mechanics of event-based trading,” the companies jointly announced. “Validus can be configured to flag insider or influence-based trading around key information windows, abnormal position-taking, coordinated social-driven activity, and cross-venue behavioral patterns. The platform supports integration of diverse data inputs — market, participant, funding, and external signal data — to unify fragmented environments and establish defensible surveillance practices as regulatory frameworks evolve.”