Kalshi made a little over $15 million in trading revenue in the 90 days to May 26, InGame estimates, suggesting the business — though partly seasonal and fast-growing — still needs serious sustained growth to catch up to a rumored multi-billion-dollar valuation.

The new figures suggest that Kalshi’s revenue wouldn’t be enough for even a 1% share of the U.S. regulated sports betting market, which makes around $3 billion a month.

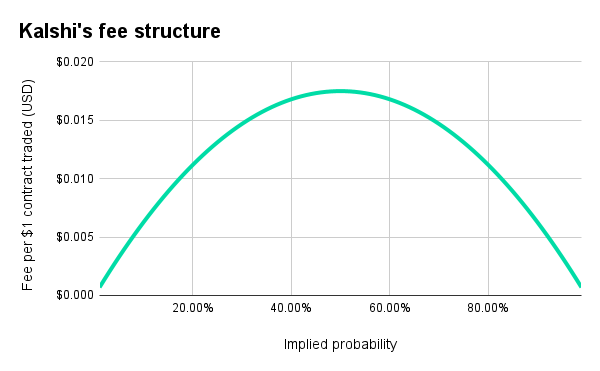

InGame analyzed every trade reported by Kalshi for the 90-day period between Feb. 25 and May 25. Data for April 1 was not available. Using Kalshi’s fee structure (below), InGame was able to estimate revenue from these markets.

Analysis of the millions of trades, worth over a billion dollars, in this time period, show Kalshi’s total estimated fees for this period — including sports and non-sports markets — was $15.2 million.

That included $11.4 million in sports event contract fees, and $3.8 million from non-sports event contracts. Sports contracts tend to have slightly higher fees on average than non-sports events, because trades in sports events tend to be closer to 50/50 shots.

The estimates do not include discounts that may be offered to market makers. Market makers are large institutional traders that insert liquidity into markets by offering open trading orders. This ensures that regular users can buy and sell contracts without difficulty searching for another person to trade with.

Kalshi offers “perks” including “reduced fees” for market makers, meaning its real trading revenue for the period is likely lower than the reported figures.

Customers using stock-trading platforms like Robinhood or WeBull to access Kalshi markets pay further fees. Robinhood charges a commission of $0.01 per contract, regardless of odds, on top of the Kalshi fee, which — on average — usually works out around $0.01 per contract.

Kalshi still small compared to wagering market

The combined fees average out at about $168,000 per day. Across a whole year, that would suggest annual revenue of a little over $60 million — less than 0.5% of the size of the U.S. sports betting market.

There are reasons to think Kalshi is on course for higher annual revenue: With more and more people buying contracts, Kalshi has been taking in more in fees — powered by growth in sports — and traditional sportsbooks typically have their best months during the NFL season, meaning figures from February to May may not be fully representative of its potential.

However, looking just at individual months, Kalshi still fails to hit even 1% of the U.S. sports betting market, even if its non-sports revenue is included.

In a recent LinkedIn post, Jonathan Lerner of EV analytics pointed out that Kalshi’s revenue numbers were a tiny fraction of its betting volume totals, which have been more widely reported.

“Aside from the legal issue(s) these prediction markets face, the economic reality is something that not much attention is focused on,” Lerner wrote. “Incredibly low-margin business despite the massive handle numbers that are being pumped into the news cycle.”

Kalshi’s handle remains unknown. While trading volume is seen as the equivalent of handle for prediction markets, it’s not a like-for-like comparison. If a Kalshi user buys a contract at a low price and cashes it out at a higher price, both trades are counted toward volume, while a similar pair of transactions at a sportsbook would only count once in terms of betting handle.

Traditional sportsbook revenue has averaged around 9% of handle nationwide so far this year while it appears that prediction-market revenue averages roughly 1% of volume.

Kalshi’s data does not provide information on trades by user, meaning it is not clear when a trade may involve a user closing out a position they opened earlier.

Can it catch up to sky-high rumored valuation?

The figures — and comparisons to other businesses that, like Kalshi, make most of their money from bets on sports — could raise questions about the prediction exchange’s potential valuation at its next funding round.

The business’s last equity fundraise was in 2022, when it was little-known and did not yet offer contracts on either elections or sports. It was valued at $787 million during that round.

However, contracts traded on a rival prediction market — Manifold — suggest that the business is expected to achieve a valuation of upward of $5 billion in its next funding round.

That would give the business a valuation at roughly a third of DraftKings’ market cap, or a little more than BetMGM, based on analysts’ estimates.

BetMGM reported $657 million in revenue in the first quarter of 2025, while DraftKings’ revenue was $1.4 billion. Both said they would have made more money had sports outcomes not been unusually bettor-friendly, a factor that would not apply to an exchange operator like Kalshi.

Kalshi may need a 30-fold increase in activity to bring its revenue multiple in line with those leading sportsbook operators.

Prospective investors forecasting Kalshi’s growth will also have to try to figure out whether the business is at risk of losing its current leading market category.

Sports has been powering Kalshi’s fee growth so far, while fees for non-sports events have been close to flat, averaging only around $50,000 per day. But the states of Maryland, Nevada, and New Jersey are fighting the prediction exchange in court to block it from offering sports event contracts. Other states such as Arizona, Illinois, and Ohio have also issued cease-and-desist orders.

If Kalshi’s sports event contracts are ultimately shut down, the non-sports business does not appear to be growing quickly enough to fill that gap.

Sports makes up the vast majority of Kalshi’s trading volume, but an even larger share of its estimated fees.

Kalshi likely to grow — but by how much?

Having only offered sports contracts for four months, and election contracts for less than eight months, Kalshi’s management and prospective investors likely anticipate significant room for growth.

Sports fees have grown during the NFL and NBA playoffs and non-sports fees may get a boost during the 2026 midterm elections. Kalshi’s trading volume for the 2024 presidential election-winner market was more than $500 million, suggesting fees of about $5 million, with more traded on related markets.

CEO Tarek Mansour appears confident the business will continue to grow. He described the business as “one of the fastest-growing in America” at the Solana Accelerate event in New York last week, and suggested the business would be “aggressive” in 2026.

However, dramatic improvement to bring revenue in line with multi-billion-dollar sports betting operators may be a challenge.

Latecomers to the sports betting market like Fanatics Betting & Gaming and ESPN Bet have gained some market share, thanks in part to costly advertising pushes, but remain well short of the revenue that would typically be associated with a valuation north of $5 billion.

And unlike leading sportsbook operators, Kalshi also has no new geographic markets to enter to expand its revenue base in the U.S., as it’s already available in all 50 states.

Lower overheads?

Kalshi can also point to a business model that allows for some operating costs to be reduced, suggesting revenue should flow into profit more efficiently.

The exchange structure eliminates the need for trading teams, and unlike some sportsbooks, Kalshi does not rely on significant third-party technology.

However, businesses with the same model have not been valued dramatically differently to sportsbooks.

When Betfair — the world’s largest betting exchange — merged with traditional sportsbook Paddy Power in 2015, it was valued at £2.4 billion ($3.5 billion at the time), on annual revenue of £476 million.

There is one other factor that allows Kalshi’s costs to be lower: Its revenue isn’t subject to state gambling taxes or the one-quarter of 1% federal excise tax. State taxes can be onerously high in some states, as high as 51% in New Hampshire, New York, and Rhode Island. But an investment narrative that relies on the ability to be exempt from state taxes may be a tougher sell to prospective investors.