Robinhood offering access to Kalshi’s spreads and totals event contracts had a big impact on their volume. But even with the extra trades provided by the stock trading app, these bets were a dramatically smaller share of volume at Kalshi than they would be at a traditional sportsbook, data shows.

Robinhood provides access to Kalshi’s contracts due to its status as a registered futures commission merchant, which can partner with an exchange like Kalshi to offer its contracts.

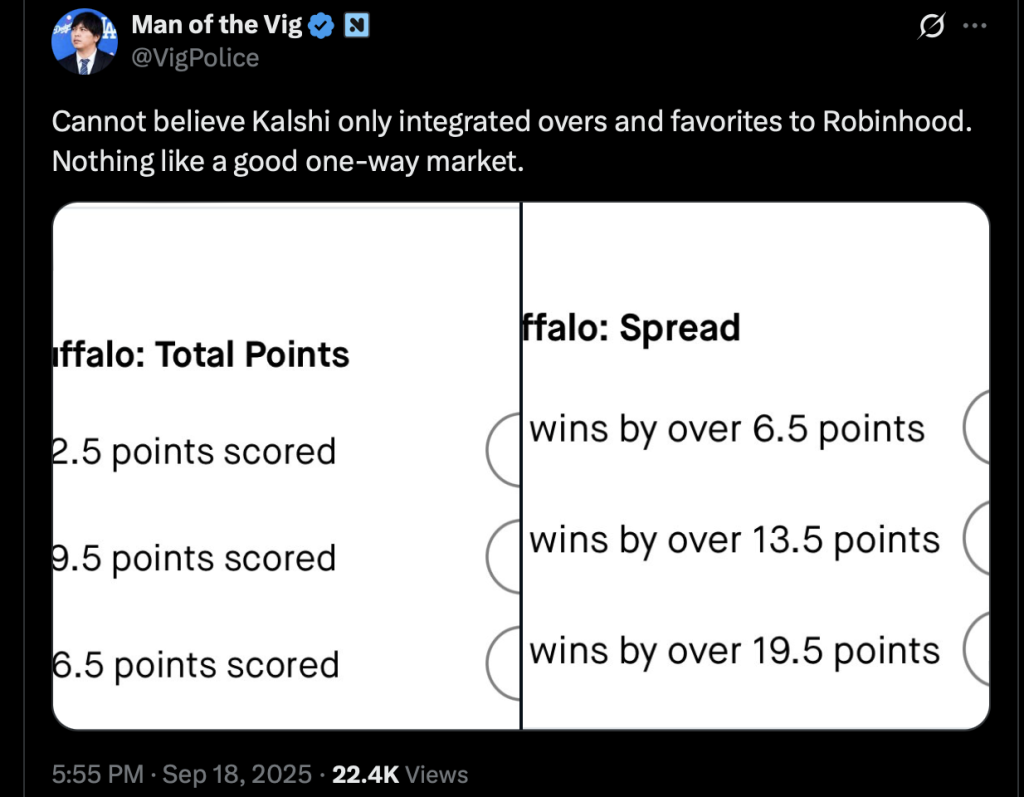

On Sept. 18, Robinhood rolled out event contracts on point spreads and game totals, which Kalshi had offered since the start of the football season. Robinhood had previously offered contracts on NFL and college football game winners, but not other football bets.

The impact of Robinhood offering those bets could be seen clearly.

Kalshi data analyzed by InGame shows that between Sept. 11 and Sept. 15 — the Thursday-through-Monday stretch in which NFL and college football games took place — $7.1 million was bet on football spreads and totals combined, compared to $393.8 million on moneyline contracts.

But after Robinhood started offering spreads and totals, $25.2 million was bet on football spreads and totals between Sept. 18 and Sept. 22 — 3 1/2 times the previous week — while moneyline bets rose more modestly to $469.6 million.

Totals, spreads bigger for sportsbooks

That’s a major increase, but it means that the share of volume that comes from spreads and totals was still small compared to the share at sportsbooks.

Those two types of bets combined typically exceed moneyline bets in terms of handle at sportsbooks. A 2022 Rutgers University study, examining $3.3 billion worth of wagers in New Jersey, found that while the moneyline was the most popular type of straight bet in its sample, handle on those bets was still well below spreads and totals combined. In total, $537.4 million was wagered on the moneyline, compared to $404.1 million on spreads and $358.9 million on totals. Combined, that’s 42% more than moneyline handle.

The study looked at betting data across all sports, but spreads and totals are typically more popular in football than other major sports, suggesting the gap could be even larger.

Prediction market volume is not a one–to-one comparison for handle — a trader “cashing out” of a bet on a prediction market is counted twice in volume but only once in handle — but is the closest proxy. Given that spreads and totals bets are designed to have close to a 50% chance of hitting, they may be cashed out less frequently than moneyline bets on big underdogs, and therefore volume figures may underestimate their popularity to some extent.

The total fees from these contracts were also still low. Kalshi made around $357,000 in fees on spreads and totals between Sept. 18 and Sept. 22.

That may suggest that there is still significant room for Kalshi to grow its football markets even without much growth in player props or parlays, which the prediction market has offered in a more limited capacity so far. If spreads and totals could combine to just match moneyline bets in total volume, that would mean roughly $440 million more volume over an NFL weekend. That could translate to around $6.6 million more fees.

The launch of spreads and totals on Robinhood came in the third week of the NFL season with little fanfare, and the stock trading app may promote these bets more and tweak its user experience to make them more easily accessible. The current interface makes bets on underdogs and unders more challenging to find.

Alternatively, the data could suggest that betting habits on Kalshi are just different compared to that of a sportsbook.

Robinhood’s importance to Kalshi

But even with spreads and totals making up only a small fraction of total volume, the figures help to show how important Robinhood is in providing volume on Kalshi.

The increase in volume after Robinhood started offering spreads and totals suggests that Robinhood might represent around two thirds of Kalshi’s total volume on those markets. Robinhood’s chief financial officer, Jason Warnick, said in August that its users traded around $1 billion worth of event contracts on Kalshi markets during the second quarter of the year. That would mean Robinhood trades made up 53% of Kalshi’s total volume during the period.

If it is comprising two thirds of volume, that would mean volume from Robinhood already hit $1.3 billion within the first 23 days of September. Unlike Kalshi, which charges dynamic fees that depend on the price of a contract, Robinhood charges a one-cent fee on all contracts, regardless of its odds. The fee is charged on top of Kalshi’s own fee. That means $1.3 billion in volume would have produced $13 million in revenue for Robinhood.

As it simply offers access to markets provided by Kalshi, Robinhood’s operating costs related to its event contract offering are much lower than either for Kalshi or traditional sportsbooks.

Analysis from Sporttrade CEO Alexander Kane and COO David Huffman on their Buy Low Sell High Substack estimated that almost 95% of Robinhood’s gross revenue from sports event contracts would flow through to gross profit. In contrast, they estimated around 60% of FanDuel’s revenue becomes gross profit.

If accurate, Robinhood may already be bringing in close to $15 million of monthly gross profit from event contracts during the NFL season.