Polymarket may have dramatically widened the scope of its testing as the Commodity Futures Trading Commission (CFTC) finally published the self-certification filings that appeared to be holding up the exchange’s U.S. launch.

As reported by InGame soon after the shutdown began, Polymarket’s U.S. launch had been held up by the lapse in government appropriations.

The CFTC’s stance was that self-certifications were stayed, and therefore would not be valid. While Polymarket’s rules were approved and it had received an exemption to certain reporting requirements — key steps toward launch — Polymarket still needed to self-certify contracts before it could offer them to the general public.

Polymarket published self-certifications on its own website on the first day of the shutdown. They were then not listed on the CFTC website while the shutdown was ongoing.

By Monday, after the government shutdown ended, the CFTC had published Polymarket’s self-certifications, alongside a range of others from exchanges like Kalshi and Crypto.com. The Polymarket submissions were dated to Sept. 30, the day they were sent. Because the filings were backdated, it’s not clear exactly when they were processed by the CFTC.

The self-certifications covered athletic event contracts, athletic spread contracts, total score contracts, and election-winner event contracts.

Polymarket testing expands

With the largest obstacle to going live apparently out of the way, the platform appears to be gearing up for a full launch, having dramatically expanded its testing.

Last Tuesday, Polymarket CEO Shayne Coplan noted that people were already being onboarded to the exchange, and that it was “effectively in a beta test.”

New data suggests that Polymarket has since expanded this onboarding from a limited testing system with only a small number of participants to more of a true beta, where the exchange is tested by a larger group of users unaffiliated with the business itself.

The platform has published time and sales reports on its regulatory website, despite having not yet launched to most customers.

Initially, the reports showed minimal trading activity on Polymarket U.S., consistent with only very limited testing. On Sunday, Nov. 9, only 61 trades were recorded, worth a combined $12,350.

On Nov. 16, however, trade activity surged. A total of 1,688 trades were made, worth a combined $546,062.

Because Polymarket’s initial reaching out to testers has focused on large-scale traders, the increase might have been due to only a small number of new customers permitted to use the beta test.

The vast majority of those trades were on NFL game winners, with the remainder on NBA game winners. No other sports — or types of bet, such as spreads or props — have been represented in any day of the trading data, suggesting that these are the only markets on offer currently. However, the wide-reaching nature of Polymarket’s self-certifications means the platform may easily be able to expand into more sports.

On Monday, the number of trades edged slightly higher, despite only one NFL game being played that day compared to 13 on Sunday, though monetary investment dipped. In total, 1,710 trades were made Monday, worth $194,186.

That Sunday-to-Monday increase in total trades suggests that access to the exchange may have expanded further.

While Polymarket’s data groups trades by date according to Greenwich Mean Time, InGame grouped the data based on Eastern Time, in order to match a day’s trading with the sporting calendar. This means that the small increase in trades from Sunday to Monday was not due to trades on Sunday evening being recorded as Monday trades.

Unsurprisingly, given that Polymarket is not yet available to the wider public, the trading figures remain small compared to Kalshi, which processed more than $300 million in volume on Sunday and $115 million on Monday.

Polymarket’s US return

Polymarket currently offers a global exchange, but does not accept customers with U.S. IP addresses.

The prediction market paved the way to relaunch in the U.S. when it acquired QCEX in July. QCEX was already registered with the CFTC as a designated contract market (DCM), meaning Polymarket did not have to go through the application process itself.

It launched a waitlist for its U.S. exchange in September.

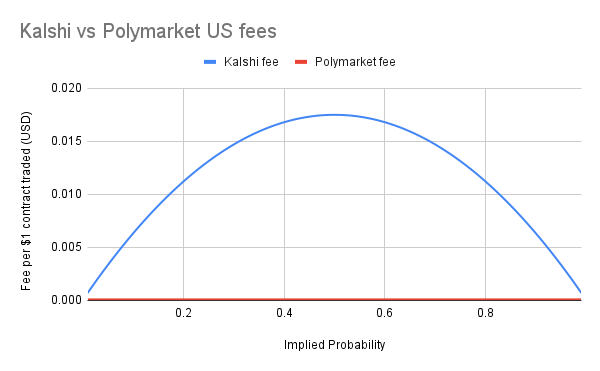

Earlier this month, Polymarket revealed the fee structure for its new U.S. exchange. Customers will pay 0.01% of the total value of a contract in fees. That rate is dramatically lower than Kalshi’s, which uses a dynamic fee structure, where fees vary depending on the odds of a contract, but average out at around 1.2%.

In 2022, Polymarket paid a settlement to the CFTC over the fact its contracts were available to U.S. users at the time. In 2024, the Department of Justice launched an investigation into the business, looking into whether it was still knowingly accepting U.S. customers. That probe was dropped in July, just before the acquisition of QCEX.