In the race to establish prediction markets as a formidable asset class focused on binary, outcome-based contracts, another asset class has emerged for which the purchase price has grown substantially over the course of 2025.

That asset is a designated contracts market (DCM) license, effectively an access-granting certification to operate a derivatives exchange registered with and regulated by the Commodity Futures Trading Commission (CFTC).

Typically, at least prior to the fall of 2024 when Kalshi won a key judicial ruling against the CFTC, the process of obtaining a DCM was a multi-year vetting endeavor, and exchanges dealt with traditional commodities like grains or energy.

But we are not living in typical times.

Full speed ahead

After winning that case, Kalshi pressed forward and generated substantial trading volume on political events contracts, in particular the 2024 U.S. presidential election. This had not yet occurred (without limitations) in the United States.

Then at the end of 2024, competing exchange and fellow DCM-holder Crypto.com advanced into sports events contracts, which many view as tantamount to sports gambling, or sports betting by another name. Kalshi followed suit in January 2025.

A wave of cease-and-desist orders and lawsuits followed that, pitting Kalshi et. al. against state regulators in jurisdictions with legal sports betting regimes, tribal groups, and various other stakeholders.

Meanwhile, the CFTC has been mostly silent in 2025, while shedding three commissioners due to resignations at a time when the Trump Administration has downsized and sidelined most federal agencies while pushing a crypto-friendly agenda. The CFTC finally gained a new chairman on Dec. 18, Michael Selig, who previously served as chief counsel on the Securities Exchange Commission (SEC) task force. Selig was approved as part of Senate Resolution 532, a“bloc vote” on 97 nominees appointed by President Trump for various government agency roles.

Against that backdrop, gambling firms and fintech companies, big and small, have been racing to market with exchanges where volume-driving sports events contracts have ruled the day. The coveted thing here is the ability to facilitate trading/betting nationwide, including in California and Texas where full-fledged online sports betting is not currently legal. Plus, managing prediction markets at the federal level requires adherence to some base standards, but circumvents having to pay state taxes or follow state-based licensure and regulatory requirements.

Put another way: Time is of the essence while competitors advance and the legal cases bubble up into circuit courts, on a crash course with the Supreme Court, but perhaps not until 2027 or 2028. At that time a different administration may interpret or enforce federal and state laws differently, with respect to the legality of sports event contracts.

“Given the launch speed of historically endemic and non-endemic players, it’s no surprise stakeholders are searching for accelerated paths to market,” said Lloyd Danzig, managing partner at Sharp Alpha, a venture capital firm focusing on competitive entertainment. “Buying dormant or active DCMs, partnering with existing DCMs or FCMs, or forming non-clearing FCMs and outsourcing execution appear to be popular tactics alongside becoming an FCM or obtaining DCM status directly.”

Danzig makes reference to futures commission merchants (FCM) licensing, a status obtained through the National Futures Association, which is how Robinhood has operated in partnership with Kalshi to this point. Seeing the explosive growth of sports events contracts on its platform while supplying the all-important active user, Robinhood Nov. 25 announced a joint venture with Susquehanna International Group (SIG) coinciding with the acquisition of a 90% stake in MIAXdx, registered as a DCM holder as well as a derivatives clearing organization (DCO) and already operational in the cryptocurrency space.

While the purchase price for the stake in MIAXdx was not announced (MIAX retains a 10% equity stake), Robinhood has customarily announced acquisitions costing greater than $100 million.

DCM purchase prices, terms

| Company | Acquired | Licenses | Deal terms | Date announced |

| Polymarket | QCEX | DCM + DCO | $112m stock + cash | July 21, 2025 |

| DraftKings | Railbird | DCM | $50m + $200m possible in performance incentives | Oct. 21, 2025 |

| Kraken | Small Exchange, Inc. | DCM | $100m in stock | Oct. 16, 2025 |

| Robinhood & Susquehanna | MIAXdx | DCM + DCO + SEF | Under $100m | Nov. 25, 2025 |

DraftKings, although it acquired Railbird for what may reach $250 million if all of the built-in upside is realized, launched DraftKings Predictions on Dec. 18, but with CME as a partner, while using its status as an introducing broker.

“We set up the business so it can be multi-exchange at its core,” DraftKings SVP for Predictions Jeanine Hightower-Sellitto told InGame. “Clearly Railbird offers a giant opportunity for DraftKings, but it doesn’t limit us from also connecting with other exchanges. We are actively working to launch it in the near future. Launching an exchange is not a trivial experience, but we’re working to bring it live.”

CME is also partnered with FanDuel, which launched on a more limited basis, in only five states, on Dec. 22.

“The shortcuts to market access boil down to two primary options: buying or renting licensure and clearing capabilities,” said Danzig. “CME has become a popular venue partner with gaming operators positioning themselves as the distribution layer and often building an FCM structure around it.”

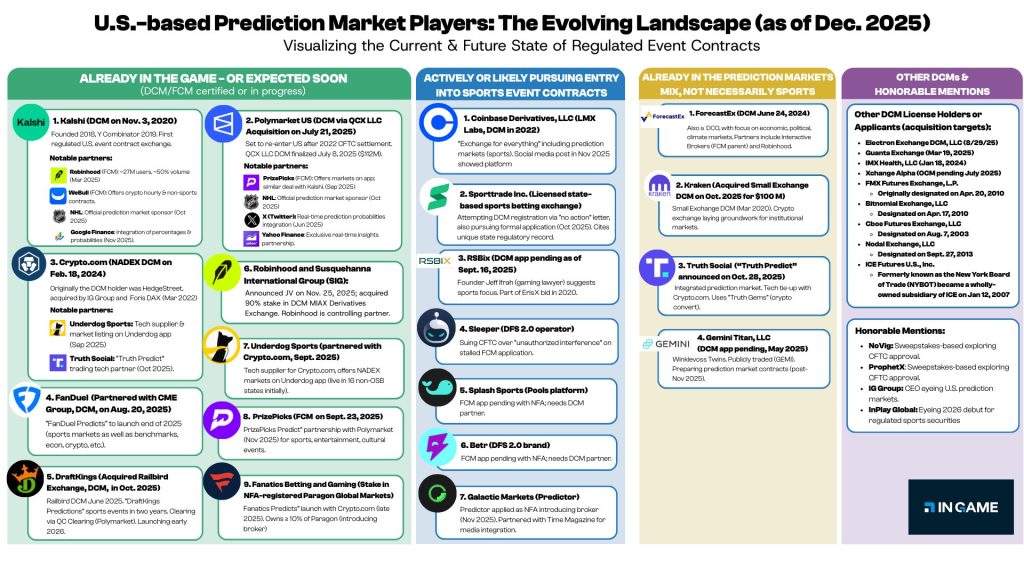

There remains a list of companies holding DCMs, identified in the below graphic shared by InGame on Dec. 1. Probably most or all of them — some registered with the CFTC for upward of 15 years, some active and some not — have engaged in at least preliminary discussions with gambling or fintech or adjacent companies about acquisition or partnership.

“We appear to be at peak euphoria, and that’s always the best time to sell an asset,” said Davis Catlin, managing partner at Discerning Capital, an investment firm specializing in regulated gaming. “Exchanges are always valuable, but we’re in a window where optimism outweighs the current economics. It’s the perfect selling conditions, like theScore for online gambling.”

The roster of companies already in the prediction market space is now fairly long, and collectively formidable as competition. Still there are several companies with applications pending before the CFTC, including ProphetX and RSBix, and perhaps other companies quietly circling while the freight train barrels down the tracks heading toward 2026.

And don’t be surprised if the prediction market product offerings expand further come 2026, testing other bounds of legality, as well as Congress’s appetite for involvement.

“We see a wide variety of prediction market products launching in 2026,” Danzig said, “including casino games, stock trading, synthetic private company ownership, cryptocurrency derivatives, new forms of leverage, collateralization mechanisms, and more.”