When Fanatics launched its prediction market platform last Wednesday, it opened a new chapter in the ongoing battle between state-licensed sports betting operators and regulators. Prior to last week, none of the biggest state-licensed sports betting platforms were offering prediction markets — but at least six state regulators have warned operators that their licenses may be in jeopardy if they offer or have a relationship with a prediction market.

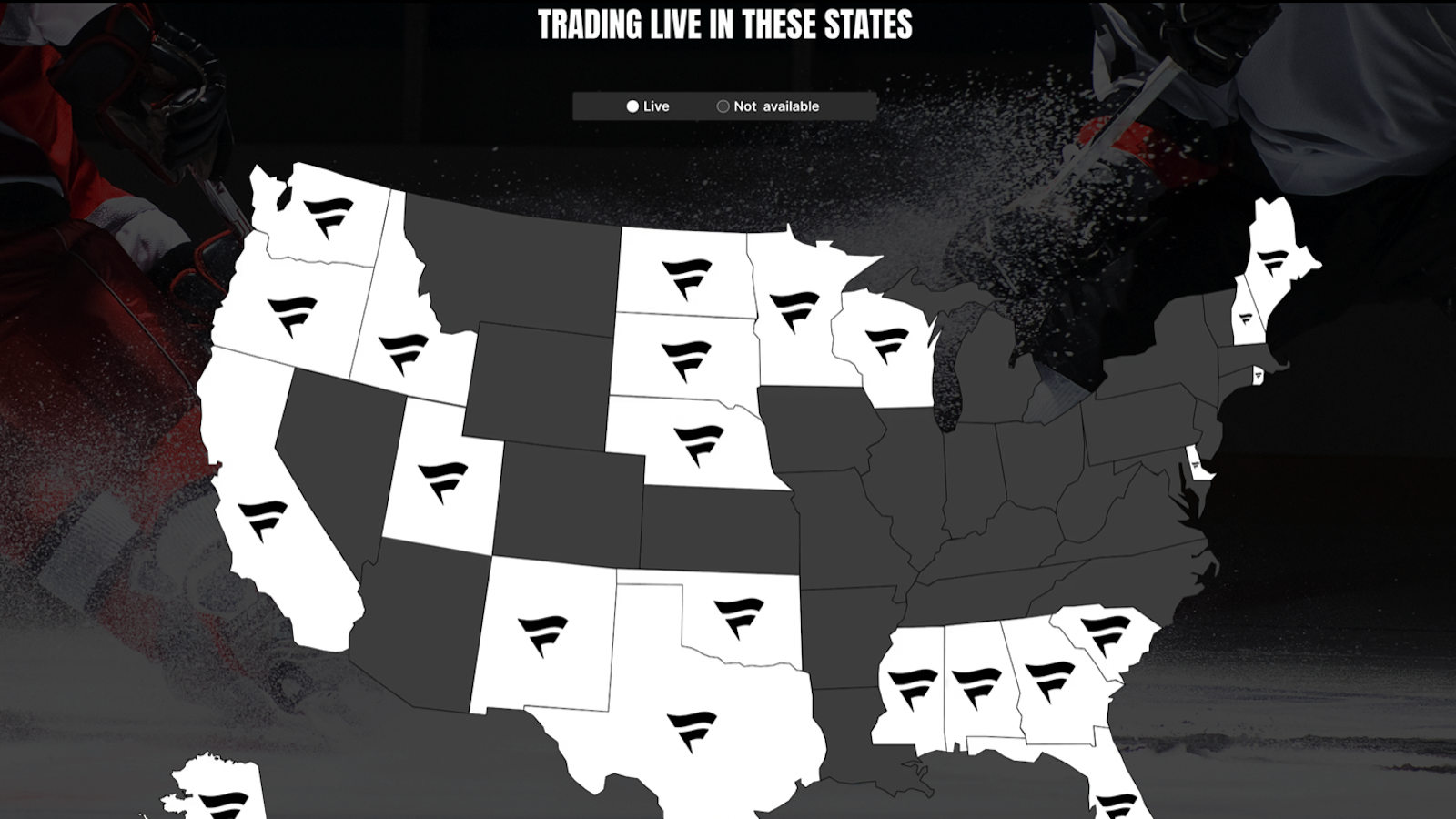

Fanatics, in partnership with Crypto.com, launched Fanatics Markets in 10 U.S. states, including six states in which some form of sports betting is legal. The company added an additional 14 states later in the week, seven of which have some form of legal sports betting. The platform is not available in any state in which Fanatics has a license.

DraftKings and FanDuel, the biggest operators across the U.S. by market share, have announced plans to enter the prediction market sphere. But Fanatics, which has been vying with BetMGM to be the third-biggest operator, beat both to launch.

The launch could be the leverage state regulators need to take further action. For example, regulators in Illinois, Maryland, Nevada, and Ohio specifically warned licensees that offering or working with prediction markets in any state-regulated jurisdiction could put a license in jeopardy. Of those states, Fanatics Sports is licensed in Illinois, Maryland, and Ohio.

But what those regulators — or others — may do remains a question. DraftKings, Fanatics, and FanDuel might be too big to fail.

The regulators wrote that penalties could be as severe as license revocation, but whether or not a state will pull the license of a top-tier sportsbook that generates millions (or in some cases tens of millions) of dollars in tax revenue monthly is an open question. Regulators are faced with a conundrum as they are tasked with protecting the integrity of wagering, and in some cases also with licensing operators that will generate the most amount of tax revenue for a state.

Operators could fight back

There has already been some fallout over plans for state-licensed sportsbooks to offer prediction markets. DraftKings and FanDuel resigned from the trade group the American Gaming Association (AGA) Nov. 17. Sources say they were under pressure to do so, as the group has been lobbying against the rise of prediction markets and in favor of state regulation. An AGA representative told InGame that Fanatics “relinquished their membership and are no longer a member.”

The Nevada Gaming Control Board (NGCB) is the only regulator to go down that road of ousting operators, but none of the big three wagering tech companies were live in the state, and only FanDuel had a retail license. Before the NGCB could expel FanDuel, it surrendered its license. DraftKings withdrew an application, and Fanatics had no business relationship with Nevada. The action was somewhat symbolic — though some say the NGCB protected the integrity of wagering — as the state lost only the tax revenue from a single retail sportsbook by forcing the operators out.

One former regulator told InGame it would make sense for regulators to wait until a state-licensed wagering operator had launched a prediction market to take action. Now that that has happened, should a regulator attempt to make good on its warnings, the process may become complicated. A regulator could impose a fine or even try to revoke a license, but licensees have the right to fight back — which could mean that a decision would ultimately be up to a court.

No state legislature has passed a law deeming prediction markets illegal, so no state regulator has a state law to use. The Arkansas attorney general wrote an opinion saying he believes prediction markets are illegal, and the Massachusetts attorney general sued Kalshi over its right to operate in the state.

“Commissions would have to prove that they are revoking a license for a reason that is not arbitrary and capricious,” the former regulator said. “And every state is different with standards. This is where it gets interesting, is if an operator says they are going to fight.

“Regulators have broad authority to say someone doesn’t have good moral character or you’re undermining the public’s confidence. So the buckets are broad, but squishy — what does that mean? As an operator, I might say, ‘I respect your position, but it’s federally regulated. How can you say that I have bad moral character or am undermining confidence when this is federally regulated?’ Do regulators really have a leg to stand on?”

The industry won’t know until a regulator other than Nevada’s takes enforcement action. The repercussions will be more significant in almost any other U.S. jurisdiction, because DraftKings and FanDuel account for more than 80% of market share in digital betting across the U.S. Both, along with Fanatics, also offer online casino platforms in several states.

License revocation a big deal

From the operator’s side, having a license revoked could have massive implications, as all U.S. jurisdictions consider the status of licensees and potential licensees in other states.

“Most licensees would want to avoid any kind of adverse action because if you have a license in Jurisdiction A, it affects Jurisdiction B,” the former regulator said. “So, a state could say we’re going to do this, and I think a lot of states are generous and would give a licensee a chance to withdraw.”

But if an operator chooses to fight back, the decision will be left to the courts. Suppliers already find themselves in an awkward position, and that position could become even more uncomfortable now that Fanatics Markets is live, and more so when DraftKings and FanDuel launch their prediction markets.

While no state regulator has threatened supplier licenses to date, those could come into play, as well. Should a regulator begin pulling licenses for suppliers providing vital services, such as back-end systems, data suppliers, geolocation companies, or payment processors, then some operators would lack the necessary tools to operate in a state-regulated environment.

“It’s hard to make a plan when the regulators are threatening to do something but they might not have the authority to do it,” a representative from one supplier told InGame. “This is the operators’ battle to fight. They are going to be reviewed first. … If our operator is comfortable continuing in that market, then so are we. They are really fighting this battle.”

The representative also said that suppliers might write into their contracts that they have the right to void a contract if the operator does something that would threaten the supplier’s license.

Every state application for operators, suppliers, and vendors includes the question, “Has your license been revoked in any jurisdiction?” A “yes” answer sends up a red flag, but if an operator or supplier chooses to withdraw, then it can better manage the question. The supplier representative said the easy answer in that scenario is to say that the company withdrew because it either lost a customer in the jurisdiction or that it no longer made sense for them to to business there.

In the same scenario, an operator also has more freedom to frame a withdrawal than a revocation.

Size matters

It’s important to note that only four state-licensed sports betting operators so far have launched or announced their intent to launch a prediction market. The fourth is Underdog, which is historically a daily fantasy platform, but is live with traditional sports betting in North Carolina. Underdog is live in more than 20 states with prediction markets in partnership with Crypto.com. The company was awarded a license in Missouri, but opted not to go live on launch day. It is also licensed in Ohio, but has not launched there.

It appears that Underdog will embrace prediction markets over traditional sports betting. But DraftKings, Fanatics, and FanDuel will attempt to offer both in different markets, leaving regulators with a difficult choice as compared to what a regulator would do should a smaller state-licensed company choose to offer prediction markets outside of the regulatory structure.

One source told InGame: “A state may not care if the $200,000 in revenue [from a small operator] goes away. Now that it’s DraftKings and FanDuel, will we see some backpedaling?”

It’s a good question, though during third-quarter earnings calls, executives from DraftKings and FanDuel seemed to believe they would not get pushback from regulators.

Risky business

Regulators also have the option to fine operators, but multiple sources told InGame that fines would be ineffective if an operator pays but continues to operate. “It would have to be, ‘We’ll fine you, and you have to stop,'” a second former regulator said. In the broadest picture, it appears fining won’t really be an effective tool in this scenario because the end game is to shutter a platform.

Both former regulators told InGame that what DraftKings, Fanatics, and FanDuel are doing is “risky” but at least two of those companies have been down a similar road with daily fantasy sports. DraftKings and FanDuel trace their roots to daily fantasy, and continue to offer robust products that remain unregulated — in both legal and non-legal sports betting states.

“They’ve been there before and they have taken that risk,” the ex-regulator told InGame. “And they are maybe saying, ‘Let’s get back to the disruptor and see how it goes. Are we now really too big to fail in the regulated states?'”

Time will tell.