DraftKings is set to spend $50 million on launching its prediction markets this year, a Wall Street analyst estimated, as CEO Jason Robins said Friday the company will not “spend foolishly” to compete in the event contract space.

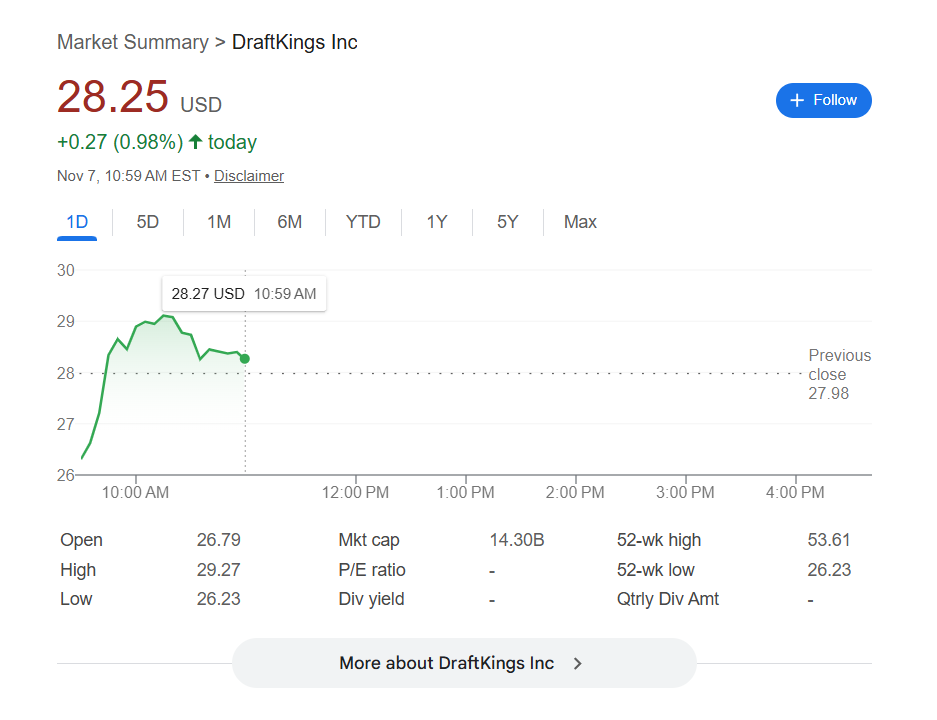

DraftKings’ stock price bounced around after earnings were released Thursday, down nearly 11% in after-hours trading at one point, before bouncing back Friday morning.

The sportsbook giant announced plans Thursday to offer sports event contracts “in many states” in the “coming months” alongside its third-quarter results. It was the first time that DraftKings revealed it would offer sports on its new prediction market platform, which it announced last month after acquiring Railbird, a prediction market already registered with the Commodity Futures Trading Commission (CFTC).

In a note to clients, Susquehanna analyst Joe Stauff calculated that DraftKings’ new full-year guidance implies that the company expects to spend $50 million on “launch costs for its predictions product.” DraftKings dramatically slashed its earnings guidance from between $800 million and $900 million to between $450 million and $550 million. Most of that impact was from “customer friendly” sports results in the third quarter and into October, but the remainder is largely the impact of launching DraftKings Predictions.

On DraftKings’ third-quarter earnings call Friday morning, Robins said that DraftKings would be conservative with how it spends to acquire customers for its prediction market because there isn’t enough information around what the long-term value (LTV) of acquiring a customer might be.

“What we’re going to do is the same thing we do with everything, which is to be very data-driven, very analytical,” he said. “So we’re going to be very conservative with LTVs, because we don’t have any data, so in that situation being conservative is best,. And then we don’t know what the landscape will look like long-term . . . It’s an exciting area, something we’re very bullish about, but we have zero data.

“As far as total investment, while we don’t have that data, I really don’t know, but we’re not going to spend foolishly.”

Kalshi, Polymarket have money to spend

With prediction market leaders Kalshi and Polymarket privately held, their spend on prediction markets is harder to discern. However, both have raised hundreds of millions of dollars, suggesting large war chests to compete for market share.

Last month, Intercontinental Exchange (ICE), which owns and operates the New York Stock Exchange (NYSE), made a $2 billion investment in Polymarket. Days later, Kalshi CEO Tarek Mansour revealed that the company had raised $300 million in a funding round led by venture capital big-hitters Sequoia, Andreessen Horowitz, and Paradigm.

While Robins said DraftKings would be conservative, he also pointed to the company’s staff and experience with sports betting, as well as its media partnerships — the company signed an exclusive agreement with ESPN on Thursday — as reasons why he was confident that it would be a winner in the world of prediction markets. The ESPN deal happened just after the media giant announced Thursday that it was ending its partnership with Penn Entertainment and ESPN Bet, which will shutter Dec. 1.

“Product, customer, experience, marketing, all those are things that we have an extraordinary level of expertise around,” he said. “So I view that as a huge advantage, along with our brand. People already associate us with sports.

“Along with the media we have, the partnerships we have, it’s going to be really tough to compete with us.”

Parlays won’t be sportsbook level

Robins also discussed the idea of offering parlays — a major source of revenue for DraftKings’ sportsbook — on the prediction market platform.

He said that it would not be possible to offer prediction market parlays that are competitive with a sportsbook’s offering, but that he believed those offered on DraftKings Predictions could still be a better product than those on other prediction markets. Kalshi’s launch of a build-your-own parlay feature in September contributed to a sell-off of DraftKings shares, but so far the prediction market’s volume on multi-leg bets remains low.

“You can do some pre-packaged stuff, but to really have a parlay offering that looks anything like an online sportsbook is impossible,” Robins said. “In this case, as a market maker, you have to create liquidity pools around these things and you don’t always have control of the other side, of who’s betting. And then just having individual liquidity pools is hard because you spread out your liquidity.

“We will, because of our pricing models and our IP, be able to put out a better version of that than others have done, but I still think it would be very limited compared to our traditional sportsbook product.”

Robins: Regulator talks gave us ‘comfort’

DraftKings will focus its sports event contract launch on states where its sportsbook is not available, a decision that Robins said was made because DraftKigns respects its state sportsbook licenses. Regulators in Arizona, Ohio, Illinois, New York, and Michigan have warned sportsbook licensees about offering prediction markets, which are not state regulated.

Some regulators have told licensees that offering sports event contracts in another state could be grounds to suspend or revoke a sportsbook license. However, Robins said his company had “comfort” in its path after discussions with state regulators.

“We really value, and treat with the utmost importance, our relationships with regulators,” he said. “We’ve had numerous conversations with them. And I think through the strength of those conversations we got comfort.”

Shares volatile as markets digest news

Wall Street struggled to digest the combination of weak results.

When DraftKings’ third-quarter results came out Thursday, the shares initially plunged in after-hours trading, by 10.6% to $24.99, due to the weak results and lower full-year guidance. That initial plunge was likely mostly driven by algorithmic traders reacting only to the results and guidance changes.

When trading opened Friday morning, the shares were still down 6% at $26.31, which was yet another two-year low for the sportsbook. However, as markets opened, investors looked past the results themselves and appeared to be buoyed by DraftKings’ bold moves on sports event contracts. That triggered a turnaround in investor sentiment with shares up by as much as 4.1% to $29.20.

However, those gains also appeared to fade, with DraftKings shares only up moderately by 11 a.m. ET.