FanDuel appears content to wait much longer for its prediction market product to make a profit than it has done for new state sportsbook launches, as payback of its initial investment over the next two years does not appear to be on the horizon.

Documents filed by CME — FanDuel’s partner for its prediction market launch — to the Commodity Futures Trading Commission (CFTC) last week show that the exchange is planning on charging a one-cent fee per one dollar of contracts traded.

CME-rulesThat one-cent fee would make the new product competitive with Kalshi on price, though notably more expensive than Polymarket when it relaunches in the U.S. Kalshi’s fees depend on the odds of a contract, but average out at about 1.2%.

FanDuel parent company Flutter’s third-quarter report shows that “CME Group will receive a revenue share of approximately 50% of the gross revenue generated by FanDuel Predicts.”

That would mean FanDuel would make around half a cent for every dollar of contracts traded.

Payback periods

FanDuel has often discussed its “payback periods” how long it takes for cumulative revenue within a state to exceed cumulative spending. The operator — like any new entrant in a market — expects to lose money at first when it enters a state. The payback period is therefore the time it takes for those losses to be canceled out by later profits.

For its sportsbook, FanDuel says its payback period is less than 18 months.

But for its prediction market, it appears like it would take much longer before the product will start to generate a positive contribution to profits.

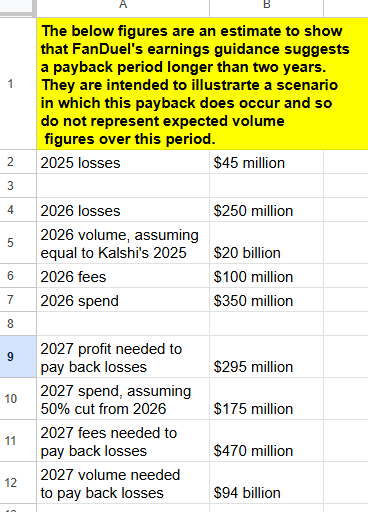

In its third-quarter report, FanDuel revealed that it would take a loss — in terms of adjusted earnings before interest, tax, depreciation, and amortization (EBITDA) — of between $40 million and $50 million on prediction markets in 2025. That would then increase to between $200 million and $250 million in 2026.

That would mean the product would have to make between $240 million and $350 million in EBITDA profit for FanDuel within the first five months of 2027 to pay back those losses. Even if FanDuel cut all spending on the product to zero during this period that would require an implausible $48 billion in trading volume during the five-month period at the beginning of 2027.

Currently, volume for CFTC-registered prediction markets in 2025 — across the entire U.S. — appears set to fall between $20 billion and $25 billion, with the vast majority coming from Kalshi.

The total size of the market in 2026 and 2027 will likely be higher, but FanDuel Predicts will only operate in around half the country and will be competing against other players — not just Kalshi but new entrants — for market share.

In a note to clients this week, Macquarie analyst Chad Beynon calculated that the “near-term” total size of the market in non-online sportsbook states may be $30 billion annually.

Therefore, it appears that FanDuel’s payback period for prediction markets will be longer than for sportsbooks.

Even paying back its losses within two years appears unlikely. If FanDuel were to cut its spend in half from 2026 to 2027 — and assuming its volume in 2026 is similar to Kalshi’s volume across the whole U.S. in 2025 — the new product would likely need to process $90 billion in volume in its second full year of operation, more than four times Kalshi’s expected 2025 volume, for FanDuel to pay back its initial losses.

Adjusted EBITDA excludes a range of costs that are usually seen as non-recurring, as well as tax and interest. It almost certainly takes longer for a new market entry — whether for a sportsbook or a prediction market — to have a positive benefit on FanDuel parent company Flutter’s net profit.

Two-cent user fee still won’t mean profits soon

It is possible that CME’s one-cent fee is in addition to a one-cent fee charged by FanDuel, which again would give each party 50% of revenue. A FanDuel spokesperson declined to provide further information on the exchange’s fees, such as whether it was charging an additional one-cent fee on top of CME’s.

But even in this scenario, it does not appear that FanDuel could pay back its costs of entry before 2028.

FanDuel Predicts would still need to process somewhere around $66 billion in volume in 2027 to make up for its losses.

Higher fees are likely to limit volume to some degree, even if customers may not be perfectly price-sensitive.

A flat two-cent fee for users would make bets on heavy favorites or longshots extremely unprofitable. Under this structure, bets at 99% probability would be guaranteed money-losers and bets at 1% probability would have a vig of around 66%.

The fees for Kalshi’s offering on Robinhood average out at close to two cents per contract, though Kalshi’s fee structure means that the cost of bets on favorites and longshots is less extreme.

FanDuel may be fine with slower payback

FanDuel may also see reason to deal with a longer wait for this new launch to make a profit.

Databases have been a hot topic in sports betting, with FanDuel’s and DraftKings’ daily fantasy databases helping the pair establish a leading position when state-regulated sportsbooks first became available. FanDuel has said that it will stop offering prediction markets in any state that legalizes sportsbooks, suggesting that it may consider the product to be a useful tool to build databases to prepare for sportsbook legalization.

Meanwhile, after the first few years — in which money will be spent on marketing and building the FanDuel Predicts app — costs could fall to be dramatically lower than the recurring costs a sportsbook may face, as CME will handle exchange-related expenses.