A late-year surge helped Kalshi make $263.5 million in fee revenue in 2025, the vast majority coming from sports, putting it on a similar scale to the third tier of U.S. sports betting operators in terms of full-year performance.

The upstart platform’s growth as the year went on, however, suggests its revenue from fees in 2026 could be significantly higher.

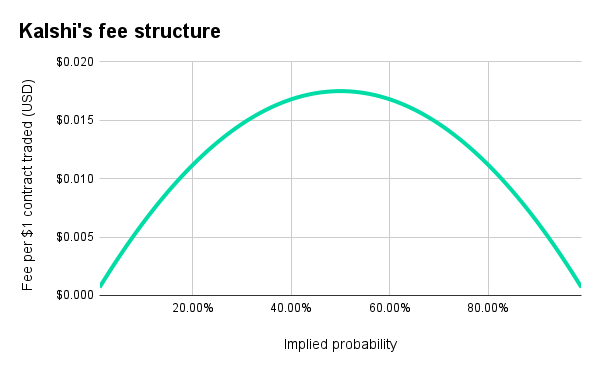

Fees for purchasing contracts are Kalshi’s main source of revenue. The fee the platform charges varies depending on the odds of the contract, with higher fees for events close to 50/50 and lower fees for extreme favorites or longshots. This system, unlike flat fees, ensures that there is no price at which a bet would be a guaranteed loser or where the fees paid exceed the stake.

Applying Kalshi’s fee formula to its data from 2025 shows that the business experienced dramatic growth in revenue as the year progressed, mostly powered by the NFL season.

The fees were based on $22.88 billion worth of volume, meaning that fees represented a little under 1.2% of total volume.

The fees measured here are ‘taker’ fees. Kalshi also charges ‘maker’ fees for resting orders that are accepted, but these only exist on some markets, and are often canceled out by fee rebates for large market makers or incentive programs for smaller ones.

Of that $263.5 million, the vast majority — at $234.6 million — came from sports, with less than $30 million coming from non-sports markets, which were mostly elections and Federal Reserve decisions.

That means 89% of Kalshi’s fee revenue came from sports, with the sports share well over 90% for the final four months of the year.

Non-sports markets did grow as the year went on, but nowhere near as quickly as sports markets. Fees as a percentage of revenue also tend to be higher on sports markets, because more of them are close to 50/50 events.

Reporting for the state-regulated U.S. sports betting market is not yet complete, but it appears that total operator revenue for the year will be around $16 billion. That would mean Kalshi held around a 1.5% share of the U.S. sports betting market in 2025 as a whole.

However, as a new entrant with little brand awareness at the start of the year, Kalshi’s market share was much higher in the final few months of the year, during NFL season.

From September to November, Kalshi’s sports fee revenue was $138.0 million. That suggests a nearly 3% market share for Kalshi, which would put it roughly seventh among U.S. sports betting operators – behind FanDuel, DraftKings, BetMGM, Fanatics, Caesars, and Bet365, but ahead of Rush Street Interactive and theScore Bet.

Kalshi finished year strong

In December, Kalshi performed even better, with $63.5 million in revenue in that month alone. With virtually no state-level data, it is too early to compare that figure to state-regulated sportsbooks, but the prediction market may well have moved further up in the rankings.

The final week of the year was Kalshi’s strongest, as it approached the $2 billion mark for volume, with the NFL and college football schedules helping to ensure high levels of sports activity on weekdays, which are typically slower due to the lack of major sporting events.

Kalshi recorded $20 million in fee revenue in those seven days, much more than it made during the first four months of the year combined.

Kalshi already looks to be on a better pace in January than December, with more than $22 million in fee revenue in the first eight days of the month.

Parlays not making much in fees for Kalshi yet

The launch of parlays was one of the more closely watched events of the year for Kalshi and contributed to dramatic falls in the share prices of Flutter Entertainment and DraftKings.

Parlays quietly became available through Kalshi’s API in mid-September, before going live on its app at the end of that month.

However, multi-leg bets continued to make up only a small share of Kalshi’s revenue.

While parlay volume came to $947.8 million, that figure may be misleading, as most Kalshi users can only bet the “Yes” side of a parlay, but the volume data includes both sides. As most parlays are at longer odds, the vast majority of volume in the data comes from institutional market makers.

Fees from parlays on Kalshi came to just $3.7 million, a tiny fraction of the volume that a major sportsbook makes from parlays. In states that report parlay revenue, the bets make up more than 50% of sportsbook revenue. At Kalshi, over the final three months of the year, they made up around 2%.

Revenue from market-making arm unknown

The fee revenue figures do not include other sources of revenue for Kalshi, such as revenue made from its in-house market-making arm, Kalshi Trading.

In November, Kalshi co-founder Luana Lopes Lara wrote on social media site X that Kalshi Trading is “not profitable.” However, she did not clarify whether this refers to its actual trading performance or whether it also includes expenses, such as employee salaries. Kalshi has never published full details of the performance of Kalshi Trading.

Details of Kalshi’s overall spending, which could help determine its profitability, are also unknown.

Earlier this month, the business revealed it had raised $1 billion at an $11 billion valuation.

Is Kalshi cannibalizing sportsbooks?

Through most of the year, industry observers have attempted to work out if prediction markets like Kalshi are taking revenue from sportsbooks and if so, how much.

On Tuesday, Citizens Bank Analyst Jordan Bender published a note attempting to quantify the “cannibilization” effect from prediction markets. Using data from Juice Reel — a platform that allows users to track their bets across both sportsbooks and prediction markets — he found users of Juice Reel typically spent 11% less on sportsbook operators after they first placed a bet on a prediction market. However, total wallet size also grew when users placed bets on prediction markets, suggesting that they are growing the size of the pie as a whole, even in regulated sports betting states.

Bender noted that Juice Reel users are not representative of the average sports bettor, as those who sign up on a bet-tracking service are likely sharper than the average customer, as well as more willing to use multiple operators.

Given that, he estimated that a more realistic figure is about half the total observed in the Juice Reel data, meaning that “5% of legal sports betting handle is going to prediction markets.” That would be $8 billion per year.

He said that would mean that the rise of prediction markets would be “a wash” for FanDuel, DraftKings, and Fanatics, which have all launched their own prediction markets, but a slight negative for sportsbook operators that haven’t.

Average wagers, Bender noted, are significantly larger on prediction markets than sportsbooks.