Placing a sports bet in Chicago could become even more expensive if a new proposal by the Chicago Financial Future Task Force (CFFTF) gains traction.

In its “Options for Chicago’s Financial Future” report issued on Aug. 31, the group floated the idea of up to a 50-cent surcharge on every mobile wager placed within city limits as a means to help alleviate a projected $1.1 billion deficit in the fiscal year 2026 corporate fund.

In July, Illinois became one of the most heavily-taxed legal sports betting marketplaces in the United States when a progressive per-bet excise tax was levied on operators and subsequently passed on to customers in various forms. Cook County, where the 234-square-mile city of Chicago is located, already imposes its own 2% tax on sports betting revenue.

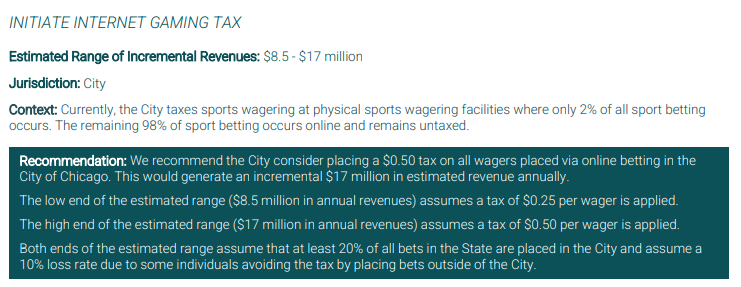

Details of the CFFTF proposal:

- 50-cent tax on every wager placed within city limits.

- The new tax would address what the CFFTF sees as a lost opportunity as the city only taxes bets at retail sportsbooks, where only 2% of betting occurs.

- The group projects from $8.5-$17 million could be generated annually. The low end of the range was calculated using a 25-cent new tax.

- Those figures are dependent on an assumption that 20% of wagers placed in Illinois emanate from Chicago. The city has a population of roughly 2.7 million, third-largest in the U.S. Illinois’ population is approximately 12.7 million, making it sixth-largest in the country.

- The group expects a 10% drop in Chicago betting activity because of bettors exiting city limits to wager.

The Sports Betting Alliance (SBA) trade group that includes bet365, BetMGM, DraftKings, Fanatics, and FanDuel responded in a press release:

“The task force proposal comes as Illinois sports fans react with alarm over the state tax. The tax also risks more fans entering the cheaper, illegal market, which is a growing concern of the state’s top consumer advocates: the Illinois Attorney General and the Better Business Bureau.”

68c9742e20efecbd01ee5692_CFFTF_Interim-Report_2025Proposal part of a lengthy budget process

Chicago Mayor Brandon Johnson is required to submit his budget recommendations to the City Council by the end of September, after the Office of Budget & Management collates requests from various agencies. After a series of hearings, the council must approve a final budget proposal by Dec. 31, for it to take effect on Jan. 1, 2026.

The proposal would make Chicago an even more expensive place to operate and wager. Last year, the state exploded its previous 15% tax rate on adjusted gross revenue, levying a 40% tax on operators generating more than $200 million annually. The lowest of the new rates came in at 20%.

In July, the state layered on the progressive per-wager tax of at least 25 cents per bet as part of a new Illiniois budget. That tax rose to 50 cents per wager once the operator took in 20 million bets in a year. DraftKings and FanDuel subsequently added transaction fees to every bet while others set new, higher minimum bet limits.

That new tax generated $5.2 million in tax receipts in its first month, according to the Illinois Gaming Board.