A Massachusetts Department of Revenue income tax report underscores the impact of the 2023 launch of legal sports betting.

In short: massive.

According to the report, from 2020 to 2023, reported gambling winnings in the state increased from $243 million to $638 million.

Sports betting – which debuted with retail shops in January of 2023, and added online and mobile that March – is the variable in the studied period because casino gambling has been available in Massachusetts since 2014. Massachusetts, which has an extremely popular state lottery – where winnings rose 5 percent to $509 million – was calculated separately.

That’s not to suggest that Massachusetts gamblers were taking down the house, however. Reported losses mushroomed from $64 million in 2020 to $231 million in 2023.

Evidence of Massachusetts’ sports betting proclivity is more than anecdotal.

Check out InGame research

- Massachusetts lifetime wagering handle: $13,759,307,120

- Gross gaming revenue (GGR): $1,317,481,155

- GGR hold: 9.58%

- State tax revenue: $256,011,237

(Revenue figures include monthly operator losses)

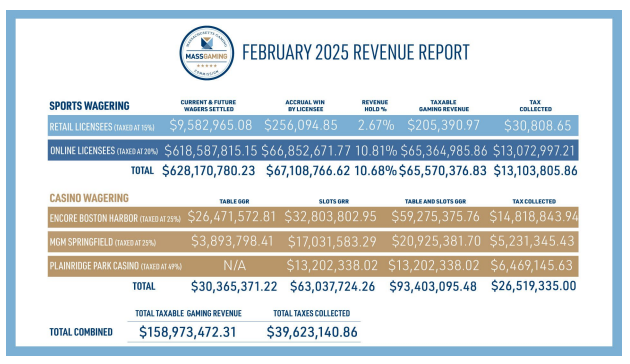

In January, the Massachusetts Gaming Commission reported a record $96 million in GGR from $762.5 million in handle. The 12.6% hold also set a new mark.

The organization reported last year that 1.6 million active sports betting accounts existed in a state of approximately 4.6 million adults at least 21 years old, the minimum age to gamble in Massachusetts.

Massachusetts is one of 42 states that requires gambling income to be reported for taxation.

The MDR told InGame that personal income taxpayers in the state are required to report all gaming winnings as either from the state lottery winnings or “Other Gambling” winnings, even if derived from out-of-state sources.

One deceased Massachusetts bettor’s money won’t fall into either category after the MGC approved his widow’s request to have $106,100 in futures bets on the Boston Celtics returned to his DraftKings account for withdrawal by his estate.