Robinhood made $25 million in fees from event contracts in October alone, and continues to make up the majority of Kalshi’s volume, the stock trading giant revealed in its latest earnings release.

In Robinhood’s third-quarter results, released after market close on Wednesday, the business revealed that its users traded 2.3 billion event contracts — each valued at one dollar — during the three months to Sept. 30. In October, trading volume was even higher than the entire third quarter, with $2.5 billion worth of contracts traded.

Those totals show rapid growth compared to the second quarter of the year, when Robinhood users traded $1 billion worth of event contracts.

Robinhood makes a one-cent fee for every contract traded, regardless of the odds. That means that the business made $25 million in prediction market fees in October.

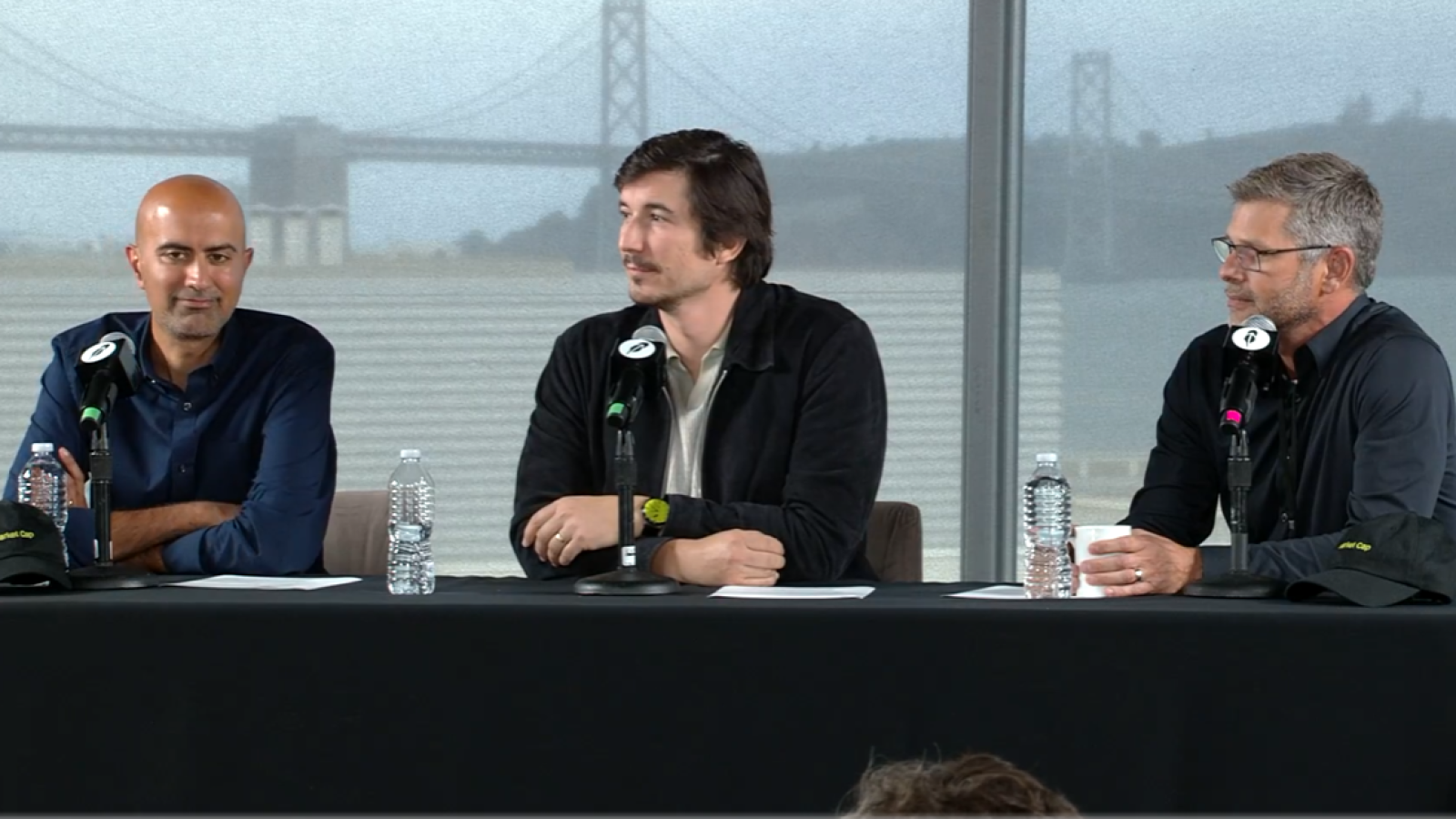

“Prediction markets are really on fire,” CEO Vlad Tenev said on the company’s earnings call. “It’s hard to believe we launched this less than a year ago.

“We love being early to this asset class, and some people are saying it could become one of the largest asset classes.”

Tenev says Robinhood has advantage

Tenev added that Robinhood’s large customer base — which still mostly trades stocks, options, or crypto, rather than prediction market contracts — gives it a natural advantage in the prediction market land-grab.

“I think one of the advantages we have entering any market — prediction markets aren’t an exception — is that we have distribution, we have lots of customers,” Tenev said. “There are 26 million funded accounts in the U.S. that are trading and using us for all sorts of things. And from an infrastructure standpoint we have a lot of tools that can be multi-asset.

“My feeling is that there’s going to be a lot of entrants into the space. And in that world, different DCMs and markets will compete for who will offer the lowest cost. And our power will be in our distribution. We’re the only ones who have the power of our traders being able to trade not only prediction markets but crypto, equities, futures. And there are advantages of everything being in one place across one simple, easy-to-use platform.”

Robinhood has expanded its prediction market offering greatly in recent weeks. This week, it added a range of entertainment markets including trading on the 2026 Oscars and Grammy Awards.

Kalshi’s trading volume for the third quarter was $4.47 billion, while for October it was $4.40 billion, trading data analyzed by InGame shows. That suggests Robinhood makes up a little over half of Kalshi’s volume, and its share appears to have edged up from Q3 to October.

In the second quarter of the year, Robinhood made up around 53% of Kalshi’s volume.

Robinhood global plans

Tenev also revealed that Robinhood hopes to generate more than half of its revenue from outside the U.S. within the next decade. Currently, it only offers access to prediction markets in the U.S.

Kalshi also announced plans to expand into 140 countries last month, though it has avoided marketing its platform abroad, a move that appears designed to limit regulatory action. Kalshi has also quietly added more countries to its list of banned territories. After initially allowing customers to register from China, the country was added to Kalshi’s blocked list Tuesday.

It’s not clear whether international prediction market ambitions for Robinhood would be via Kalshi or through a partnership with a different exchange.

When asked about how prediction markets play into its international plans, Tenev pointed out that there is often a “crypto component” to non-U.S. prediction markets. Polymarket is the largest prediction market outside the U.S. and is crypto-based.

“Prediction markets is another asset class that has a strong crypto component, particularly outside the U.S., and we’re working out what the best way may be to get that to our customers,” he said. “And we’re looking at that on a case-by-case basis, maybe depending on the jurisdictions. And I think we’ll have our pick of the options.”

Low overhead costs

Robinhood’s revenue from prediction market fees is still low compared to the company’s overall revenue, or the revenue of major sportsbooks during the NFL season. However, the expenses associated with Robinhood’s prediction market offering are low, meaning an unusually high portion of this revenue is likely to flow straight through to the company’s bottom line.

Analysis from Sporttrade CEO Alexander Kane and COO David Huffman on their Buy Low Sell High newsletter estimated that almost 95% of Robinhood’s gross revenue from sports event contracts would flow through to gross profit. In contrast, they estimated around 60% of FanDuel’s revenue becomes gross profit.