Welcome to the InGame guide to prediction market liquidity. Liquidity is the gas that powers the prediction market engine. Without prediction market liquidity, there would be no prediction markets. This page is your guide to everything related to prediction market liquidity. We will cover what liquidity means, why it is important, how liquidity can be achieved in markets, which prediction market operators have the most liquid markets, and much more. Let’s get started.

What is prediction market liquidity?

Prediction market liquidity is “a metric that shows how much the trading of contracts affects the price.” What does that mean? Let’s break it down. If a market is liquid, that means a lot of people are trading contracts, and the volume is high. The market is efficient, and the price for a contract is close to the market rate, or what people think it’s worth. Each new contract traded doesn’t change the price very much, if at all. These are good things.

Why is liquidity important in prediction markets?

The saying goes that something is only worth what someone else is willing to pay for it. This is true for pretty much anything, from cars to art to bitcoin. You can say that your watch is worth $10,000, but if no one is willing to pay more than $8,000 for it, do you really have a $10,000 watch?

In prediction markets, liquidity establishes the true value of an item by showing what people are willing to pay for it. A liquid market means that a lot of contracts have been bought and sold at different prices, leading to the discovery of a true price that doesn’t change much after each transaction. Buyers and sellers are both willing to accept the price the market has decided. The examples below show the importance of market liquidity and what happens when a market is illiquid.

Examples of prediction market liquidity

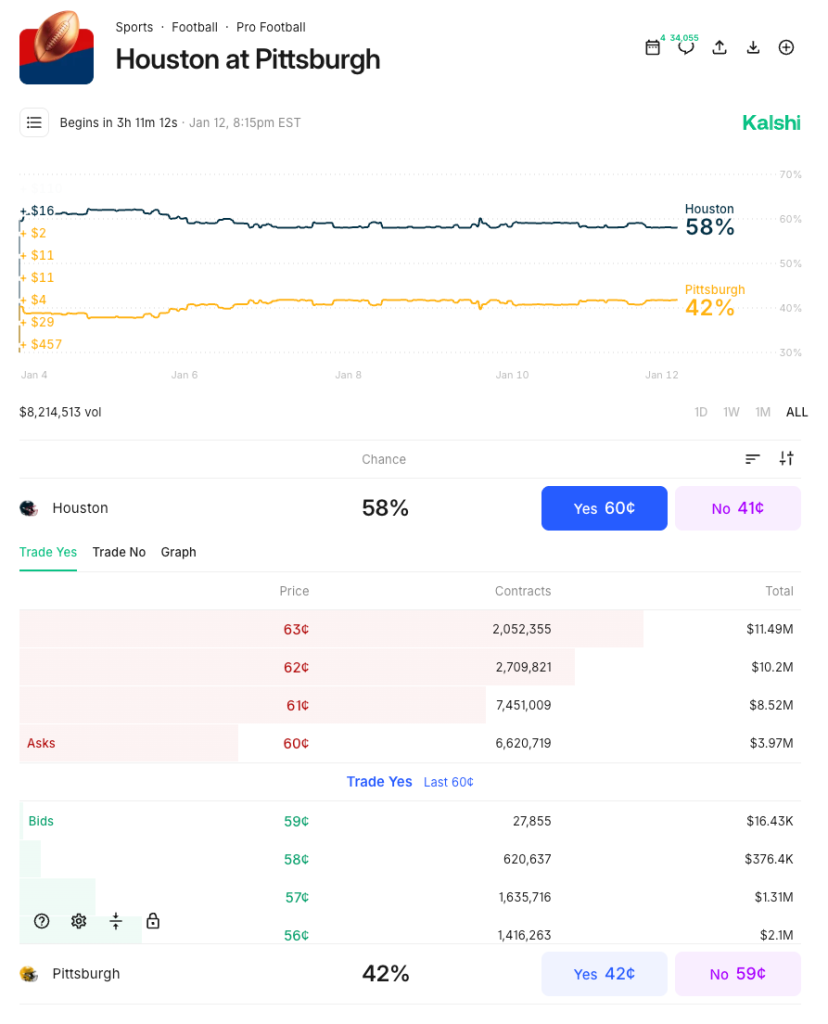

Check out this example of a liquid market. An upcoming NFL playoff game was attracting a lot of interest from traders. According to the order book, the bid-ask spread for the Houston Yes market was just one cent. Market takers were willing to pay 60 cents for Houston Yes, and market makers were offering 59 cents for Pittsburgh No, the opposite side of the contract. These prices are about as liquid as you’re going to find in a prediction market.

The screenshot above shows that anyone who wanted to buy a Houston Yes contract was highly likely to find someone else willing to take the Pittsburgh No side. The price won’t move at all because so many traders are willing to be the counterparty. This is a liquid market.

Illiquid prediction market example

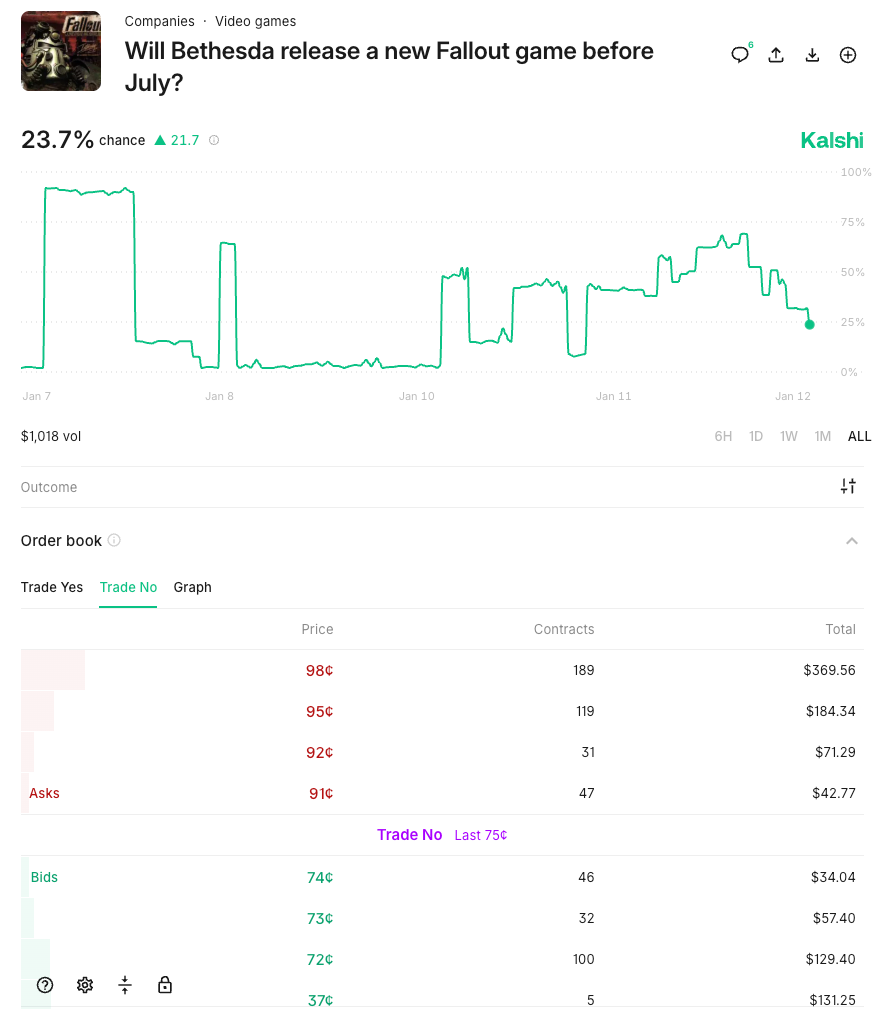

Now we will look at an illiquid market. Remember that the asking price is the lowest price at which a buyer is “asking” to sell a contract. The bid is what someone else is willing to pay for it. This market had only attracted $1,018 in volume at the time, which led to a large bid-ask spread.

Anyone who wanted to hold No contracts in this market tried to lock in the No price as close to 99 cents as possible because they didn’t think that Bethesda would release a new Fallout video game before July 2026. People who were willing to be the counterparty to that contract wanted to get paid a lot more than 1-10 cents per contract for the risk they were assuming, so their best bid offers were in the 70-75 cent range.

The order book shows a bid-ask spread of about 20-25 cents. Because interest in this market is so limited, each contract traded will move the price significantly in one direction or the other. Notice how the graph goes up and down a lot. Those movements are related to the price of contracts being traded. This is what we mean by prediction market liquidity, or illiquidity in this case. The fair market price has not been discovered and each contract traded moves the market significantly.

Prediction market liquidity vs. sportsbook liquidity

If you want to bet on a sporting event and you live in a state with legal online sports betting, you can just pull up your favorite sportsbook app and pay the price listed on the screen. The sportsbook controls the pricing because it is the counterparty. They act as the bank, taking wagers and paying out winners. There is no one else involved. Liquidity is not a concern because the sportsbook accepts wagers on everything listed on its app. The price doesn’t move unless the sportsbook moves it.

Compare that to a prediction market. As we have discussed above, the market price matters greatly because contracts are only filled if there is another party willing to take the other side. If you don’t like the price at a sportsbook, you can skip the wager or try to find a better price somewhere else. At a prediction market platform, you can try to change your price or lower the number of contracts you want to buy, but someone still has to assume the counterparty risk.

Which prediction market platforms have the most liquidity?

Every prediction market operator has liquid markets for the biggest sporting and political events. NFL games, elections, and the Oscars all have plenty of buyers and sellers with short spreads and minimal price movement. The smaller markets are where the rubber meets the road, and we have found that Kalshi and Polymarket are the most liquid because they have the biggest customer bases and the best market maker incentive programs. Robinhood and Crypto.com are solid platforms, but their main focus is not prediction markets, so they don’t offer the deep liquidity of their competitors.

For more on prediction markets, check out some of our most popular review pages below:

- Robinhood Prediction Markets review

- PredictIt review

- Kalshi review

- Polymarket vs. PredictIt

- Prediction markets explained

- Prediction markets responsible gambling

- Prediction market fees

Market makers and market takers

A prediction market is made up of market makers and market takers. Market takers “take” the price listed on the platform (they do not set the price), and market makers “make the market” by providing prediction market liquidity and agreeing to be the counterparty at a certain price.

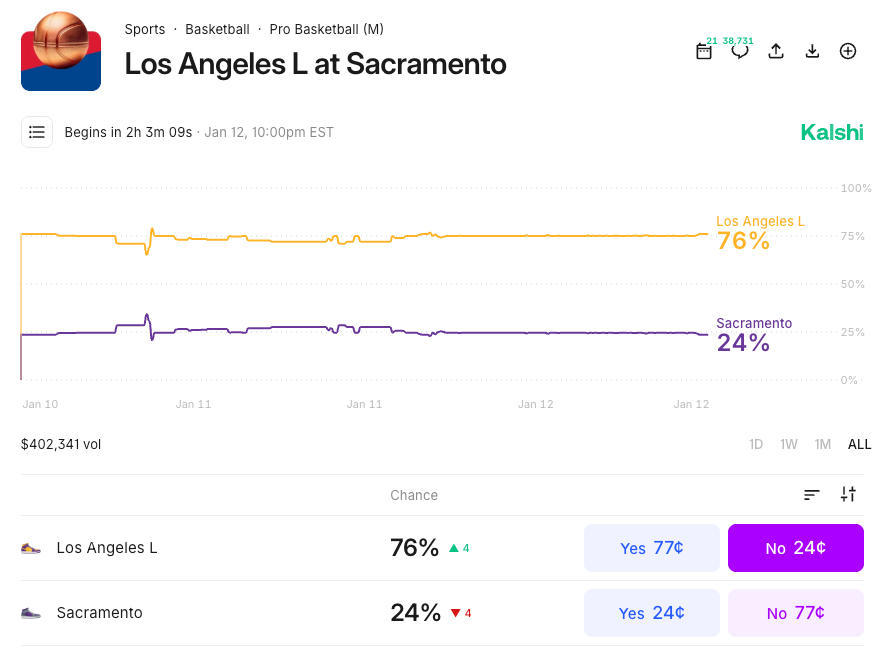

Using the above example, say you want to buy 100 Sacramento Yes contracts at 24 cents each. This would cost you $24 and pay out $100 if Sacramento wins the game. In this scenario, you assume the role of market taker. The 24-cent price listed in the screenshot is determined by a market maker. A market maker has indicated that is how much they would charge to be a counterparty to the contract you want to trade. Liquid markets like this one have many market makers eager to take the other side of the trade you want to make.

Prediction markets cannot operate without market makers. They continually agree to be the counterparty to liquid markets and also provide liquidity to illiquid markets that are one-sided or don’t attract much interest from traders. Prediction market platforms offer incentives to those who want to try their hand at market making. For example, Kalshi has a market maker incentive program that pays out cash for those who contribute liquidity to selected markets.

Glossary of key terms

I have learned a lot during my own journey into the world of prediction markets and prediction market liquidity. Since the industry differs in many ways from traditional sportsbooks, I have created a glossary of key terms. The definitions listed below are taken from my glossary.

- Liquidity – A metric that shows how much the trading of contracts affects the price. A liquid market means the price doesn’t much much at all after each trade. In an illiquid market, each trade causes the price to move significantly one way or the other.

- Order Book – A published list updated in real time that shows buy and sell orders for each market. The order book is a great tool for price discovery and to determine the liquidity of an individual market.

- Slippage – The difference between the price a user agreed to when an order is placed and the actual price when the contract is processed by the operator. Slippage occurs when the market is volatile and prices are changing very quickly. Slippage can work both ways; prices can become more favorable to the buyer or less favorable depending on the price movement.

- Market Maker – A market maker creates liquidity in the market by continually being the counterparty to someone who wants to trade. Market makers are the other side of the contract that a market taker initiates.

- Market Taker – A market taker is someone who accepts a listed contract price. They do not determine the price; by “taking” the listed price, they are the one who initiates the trade by agreeing to pay a certain price for a contract.

- Spread – The difference in price between the bid (buyer) and ask (seller) price of a contract. This may not be readily apparent because there is just one price listed on the platform for a Yes or No contract, but the Order Book displays the spread for each market listed on an operator’s platform.

- Volume – The total dollar amount of contracts traded in a market over a certain period of time.

Conclusion

Prediction market liquidity is what makes prediction markets work. Matching buyers and sellers is the whole point of a prediction market and what makes it different from a traditional sportsbook. If there are too many buyers and not enough sellers, or vice versa, the market doesn’t work because no one wants to be the counterparty.

A liquid market is a beautiful thing. It means that buyers and sellers both agree on what the market price should be and are willing and eager to trade contracts with each other. I hope this page has given you some insight into the importance of prediction market liquidity.